Bloomberg South Africa’s High Court scrapped a bid by the nation’s anti-graft ombudsman to change the central bank’s inflation-targeting mandate. The Public Protector’s instruction that lawmakers should start a process to change the constitution and amend the Reserve Bank’s mandate is set aside, Judge Cynthia Pretorius said in a ruling. The judgment removes the risk of politicians interfering in the …

Read More »Banking

HK likely to raise banks’ interest rates

Bloomberg Hong Kong’s attempt to force bank interest rates higher—seen by some as a bid to arrest losses in the local currency—has been given a big fat zero by the markets. Plans to sap liquidity by boosting debt sales triggered an about-turn in the Hong Kong dollar on Wednesday, spurring speculation over the fate of one of the world’s surest …

Read More »Money-laundering scandal hurts all banks, says lobby chief Bligh

Bloomberg The Commonwealth Bank of Australia money-laundering scandal has damaged public’s perception of the whole banking sector, according to the head of the industry’s lobby group. “The issue that Australian banks are suffering with is community trust and public reputation,†Australian Bankers’ Association Chief Executive Officer Anna Bligh said in an interview. “The events of the past week, 10 days, …

Read More »Danske tells biggest clients it doesn’t want all their deposits

Bloomberg Danske Bank A/S is telling corporate clients to think hard about what to do with their excess cash before December 31, because Denmark’s biggest lender doesn’t want it. After a world-record-setting half decade of negative interest rates, Denmark still has a few surprises up its sleeve that show how such a monetary regime works in practice. Though corporate clients …

Read More »Japanese bank plans Saudi hires to tap $350 billion privatisation

Bloomberg Mitsubishi UFJ Financial Group Inc. is looking to hire in Saudi Arabia as the lender seeks to benefit from privatisations valued at more than $350 billion over the next five years. “We are planning to start expansion in Saudi Arabia by hiring 20 people,†Elyas Algaseer, the bank’s co-head in the Middle East and North Africa, said in an …

Read More »Gold seen jumping to $1,400 at Russian bank amid tension

Bloomberg Gold prices are set to jump to a four-year high of $1,400 an ounce by the end of the year over mounting tensions between North Korea and the US, and surging demand in the world’s biggest consumers, according to the head of precious metals at a Russian investment bank. Bullion could rise to $1,360 within three months before climbing …

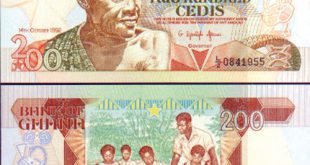

Read More »Ghana Commercial Bank takes over lenders

Bloomberg Ghana’s central bank approved a deal that will see Ghana Commercial Bank Ltd. take over the deposits and selected assets of UT Bank Ltd. and Capital Bank Ltd. after the two lenders failed to meet capital requirements. PricewaterhouseCoopers LLP will sell the rest of the assets to settle liabilities, Raymond Amanfu, head of banking supervision at Bank of Ghana, …

Read More »Draghi gets help from northerners’ pay demand

Bloomberg If Mario Draghi, the president of the European Central Bank, is looking for signs of wage growth, he might find comfort in Finland. After delivering the euro zone’s fastest pace of economic growth in the first quarter, Finnish workers have had enough belt-tightening and are now demanding pay rises they say are only fair given the rebound in exports. …

Read More »Beltone to start $1 bn fixed income fund

Reuters Egyptian financial services group Beltone Financial will launch a $1 billion investment fund in fixed income instruments in September, its chief executive officer told Reuters on Monday. The investment bank aims to raise $150 million to $200 million in the fund’s first phase, Bassem Azzab said in a telephone interview. The fund will seek to attract Gulf and European …

Read More »Bitcoin surges past $4,000 as speed breakthrough to fuel spread

Bloomberg Bitcoin soared past $4,000 for the first time on growing optimism faster transaction times will hasten the spread of the cryptocurrency. The largest digital tender jumped to a peak of $4,216 onMonday, a gain of nearly 18 percent since Friday, after a plan to quicken trade execution by moving some data off the main network was activated last week. …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.