Sharjah /Â WAM Dr. Bjorn Kjerfve, Chancellor of the American University of Sharjah (AUS) met on Monday with Sheikh Sultan Sooud Al Qassemi, Managing Director of Al Saud Company, and Sheikh Saud Majid Al Qassimi, the Deputy Managing Director of Al Saud Company, to discuss the Sheikh Saoud Bin Khalid Bin Khalid Al Qassimi Chair in Family Business, which was ...

Read More »Dubai Culture unveils ‘Live our Heritage’ Festival

Dubai / Emirates Business Dubai Culture and Arts Authority (Dubai Culture), the Emirate’s dedicated entity for heritage, arts and culture, on Monday inaugurated ‘Live Our Heritage Festival’ – held at Al Shindagha Historic Neighbourhood from April 27-23. The festival coincides with the annual World Heritage Day marked on April 18 across the globe. The festival was launched in the ...

Read More »Malabar opens one more showroom in Oman

Muscat / Emirates Business Bollywood actress Kareena Kapoor Khan launched 146th outlet of Malabar Gold & Diamonds which is 10th in Oman of at Ruwi High Street, Muscat on April 14 in the presence of MP Ahammed, Chairman, Malabar Group, Shamlal Ahamed, Managing Director- International Operations, Malabar Gold & Diamonds, KP Abdul Salam, Group Executive Director, Malabar Group, Asher. ...

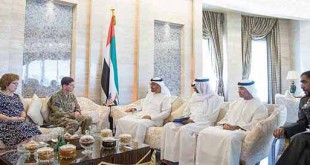

Read More »UAE, USA to boost defence, military cooperation

ABU DHABI / WAM His Highness Sheikh Mohamed bin Zayed Al Nahyan, Crown Prince of Abu Dhabi and Deputy Supreme Commander of the UAE Armed Forces, on Monday received the visiting Commander of United States (US) Central Command Joseph Votel, at Al Shati Palace. Sheikh Mohamed welcomed Votel and discussed with him friendship and co-operation between the UAE and ...

Read More »Sharjah Crown Prince to witness launch of SCRF

SHARJAH / WAM Sheikh Sultan bin Mohammed bin Sultan Al Qasimi, Crown Prince and Deputy Ruler of Sharjah, will witness the launch of the 8th edition of Sharjah Children’s Reading Festival (SCRF), which takes place on Wednesday. Organised by Sharjah Book Authority (SBA) and held each year under the directives of H.H. Sheikh Dr. Sultan bin Muhammad Al Qasimi, ...

Read More »Empower to build production capacity in Jumeirah project

DUBAI / WAM Emirates Central Cooling Systems Corporation, Empower, has awarded a contract that will boost the company’s production by 30,000 Refrigeration Tonnes (RT), according to Ahmad bin Shafar, Chief Executive Officer. “Being the world’s largest district cooling services provider in terms of capacity, we continuously work on increasing our operations to cater to the needs of our rapidly ...

Read More »Abu Dhabi Ports, Khalifa University ink pact

ABU DHABI / WAM Abu Dhabi Ports, the master developer, operator and manager of ports and Khalifa Industrial Zone in the Emirate, and Khalifa University in Abu Dhabi, signed a Memorandum of Understanding (MoU) that will pave the way for knowledge sharing, joint research projects, and job opportunities for students. Abdullah Humaid Al Hameli, Acting Executive Vice President – ...

Read More »AMAN Insurance posts AED41.2mn net profit in 2015

DUBAI / WAM The General Assembly of Dubai Islamic Insurance and Reinsurance Company (AMAN Insurance) held its annual general meeting (AGM) at Dubai Chamber of Commerce and Industry. The AGM reviewed the board’s report on the company’s activities and its financial position during the past financial year. The AGM was headed by HE Mohammed bin Omair bin Yousef Al ...

Read More »World’s largest stand-alone Audi service center opens in Dubai

Dubai / Emirates Business The world’s largest stand-alone Audi service center has been inaugurated in a VIP ceremony to commemorate the launch of a new standard bearer in car servicing and customer care. Al Nabooda Automobiles, the sole distributor of Audi in Dubai and the Northern Emirates hosted a VIP collection of government officials, dignitaries and loyal customers at ...

Read More »DEWA chief highlights role of energy projects

Dubai / Emirates Business HE Saeed Mohammed Al Tayer, MD & CEO of Dubai Electricity and Water Authority (DEWA), received HE Milos Perisic, the Serbian ambassador to the UAE, at his office. Ahmed Abdullah, Senior Manager of External Communication at DEWA, also attended the meeting. This supports DEWA’s efforts to enhance cooperation within diplomatic and council missions. Al Tayer ...

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.