The Philippines’ leading carrier, Cebu Pacific Air, also known as CEB, rounded up its fastest growing routes for the first nine months of 2015, with its low-cost long-haul flights making the cut. The countries or regions with the highest passenger growth from January to September 2015, compared to the same period last year, were Australia, the Middle East and Japan. …

Read More »TimeLine Layout

January, 2016

-

20 January

Etihad deploys state-of-the-art baggage management system

Etihad Airways, the national airline of the United Arab Emirates, has announced an agreement with Luggage Logistics to transform the end-to-end baggage management process across the airline’s global airport network. Luggage Logistics’ advanced Baggage Management System (BMS) will enable Etihad Airways to significantly improve the delivery of guests’ luggage to their destination on-time. It will also help the airline to …

Read More » -

20 January

DFW Int’l Airport welcomes Qatar Airways Cargo

Qatar Airways Cargo will launch a new freighter route connecting Dallas/Fort Worth (DFW) to its global cargo network starting on January 19. Qatar Airways Cargo will utilise Boeing 777F freighter aircraft to fly the route two times per week from DFW to Liege, Belgium. With the arrival of Qatar Airways Cargo, DFW will now have 18 air cargo carriers serving …

Read More » -

20 January

AUH Airports awards duty-free contracts to global operators

Abu Dhabi Airports has awarded contracts to two of the world’s most innovative duty free operators, Aer Rianta International and Lagardère Capital, to provide duty free concessions in the Midfield Terminal Building (MTB). The Aer Rianta International group (ARI), a leading airport retail management company with operations at airports in Europe, New Zealand, North America and the Middle East, will …

Read More » -

20 January

CAB grants CEB entitlements to UAE

The Civil Aeronautics Board (CAB), in a recently concluded board meeting, granted additional entitlements to the Philippines’ leading carrier, Cebu Pacific (PSE: CEB), for international routes from Manila to the United Arab Emirates (UAE), from various points in the Philippines to Taipei and Kaohshiung in Taiwan, and from Manila to key destinations in Russia. CEB was granted the right to …

Read More » -

20 January

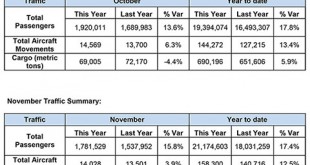

AUH Int’l Airport sees surge in UK-bound passenger graph

Abu Dhabi Airports has revealed that passenger traffic to the UK has grown by 34.2 percent over the last year, attributing much of this increase to the state of the art fleet of Airbus A380 aircraft operated by Etihad Airways. Meanwhile, overall passenger traffic at Abu Dhabi International Airport (AUH), increased by 15.8 percent in November 2015, with a total …

Read More » -

20 January

Pioneering technology services discussed at STME’s Insight Day

As part of its tradition and vision, STME, the Middle East’s leading IT solutions provider and systems integrator (SI), headquartered in Dubai, recently concluded its 2016 Insight Day. STME’s leading partners and top and middle management from across the Middle East participated in this high-profile event at Ras al Khaimah in UAE. The Insight Day was structured around internal sessions, …

Read More » -

20 January

Alpha Data launches ‘Public Cloud’ in the UAE

Alpha Data LLC, the UAE’s leading System integrator and managed service provider, has launched ‘Alpha Cloud,’ a new public cloud service that features world-class cloud functionality tailored to meet the UAE’s local cloud computing requirements. The company is one of the first local private systems integrators to launch a public cloud in the country. The debuting service reflects Alpha Data’s …

Read More » -

20 January

TRA conducts ‘Cyber Blackmail’ awareness lecture

The General Authority for Regulating the Telecommunication Sector (TRA) conducted a ‘Cyber Blackmail’ awareness lecture in collaboration with the ‘Al Ameen Service’ launched by Dubai police. Khalil Al Ali, Senior Official from Al Ameen Services, and Ghaith Al Mazaina, UAE TRA Security Quality Services Manager, participated in the lecture. The lecture’s agenda encompassed a number of significant topics that have …

Read More » -

20 January

ADIB partners with IBM to launch innovative digital studio

In line with its continuous efforts to innovate and digitise its products and services to enhance its customers’ experience, Abu Dhabi Islamic Bank (ADIB) has announced that it will fundamentally transform how it interacts and provides services to customers by building a new Digital Studio with IBM. This will further enhance the various digital innovation projects across the bank, including …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.