RIYADH / Bloomberg JLL, the world’s leading real estate investment and advisory firm, has released its inaugural ‘2016 Top Trends for KSA Real Estate’. Modelled on similar JLL reports in other markets, the KSA Top Trends will be an annual report which will assess and forecast the major trends which are likely to impact and shape the KSA real estate …

Read More »WTC project cost to be at lower end of estimate

NEW YORK / Bloomberg The total cost of the World Trade Center rebuilding project will come in at the lower end of the $14.8 billion to $15.8 billion range projected four years ago, a Port Authority of New York and New Jersey official said. The cost estimate was contained in a 2012 report commissioned by the agency’s board as it …

Read More »China’s MoF cuts taxes on home transactions to help realty prices

London / Bloomberg China’s Ministry of Finance said it will cut taxes on home transactions as it steps up support for the property market, after the central government eased mortgage down payment requirements to the lowest level ever earlier this month. China will set the deed tax at 1.5 percent of the home’s value for first residences bigger than 90 …

Read More »Yandex to buy HQ to reduce rent expenses

Bloomberg Yandex NV agreed to buy its Moscow headquarters after surging rent payments that are linked to the U.S. dollar curbed profits as the local currency lost half of its value in the last two years. The company, which operates Russia’s biggest search engine, will finance the purchase of seven buildings from Cyprus-based Krasnaya Roza 1875 Ltd. by issuing 12.9 …

Read More »â€˜Olympic condos a hard sell in weak housing market’

Rio De Janeiro / Bloomberg Some of the luxury apartments built in anticipation of the 2016 summer Olympic Games are at risk of being left unsold as the housing market deteriorates in Rio de Janeiro, Mayor Eduardo Paes said in an interview. Developers will have a hard time selling units at the 31- building Olympic Village, known as Ilha Pura, …

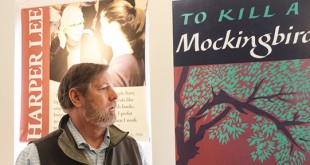

Read More »What happens to ‘Mockingbird’ money after Lee?

Bloomberg Fifty-six years ago, Harper Lee wrote her first novel, which turned out to be one of the greatest literary works of the 20th century. To Kill a Mockingbird’s revelation that in the South—or rather, in America—a black man could lose his life over a crime he clearly didn’t commit, resonates today just as it did when it was first …

Read More »Calorie on menu counts

Bloomberg Until recently, the sophisticated view about calorie labels in restaurants was one of despair: A series of studies suggested that the practice, required by Obamacare and modeled on what has been done in New York and other cities, just doesn’t succeed in promoting healthy food choices and reducing obesity. But comprehensive new research offers a dramatically different picture. It …

Read More »Cloud roadshow comes to UAE

ABU DHABI / EMIRATES BUSINESS To reiterate the cloud presence in the market, Microsoft will be hosting a free two- day training at the Hyatt Dubai Creek Heights on the 22nd and the 23rd of February. The cloud roadshow will bring technology experts to your city, who’ll be sharing valuable tips and techniques throughout this training period, allowing organisations and …

Read More »Instagram to introduce beefed up security process

Relaxnews Instagram is rolling out an authentication process that will ask users to verify a phone number, a tool that will serve to reassure its 400 million users including celebrities and brands. According to TechCrunch, the photo-sharing site is testing out the new feature following calls to beef up security from hackers. The two-step authentication process is modeled after Facebook’s …

Read More »Yahoo killing off digital magazines in food, travel and health

Relaxnews Yahoo is shuttering a slew of their digital magazines in an effort to restructure the flagging brand. In a note to readers, global editor-in-chief Martha Nelson announced that the company will begin phasing out their food, health, parenting, makers, travel, auto and real estate sections. “While these Digital Magazines will no longer be published, you will continue to find …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.