Bloomberg The pound rallied and UK bonds surged as more of Prime Minister Liz Truss’s package of unfunded tax cuts were reversed. Stocks rise, with investors preparing for a number of key earnings reports this week. Chancellor Jeremy Hunt said the UK will raise £32 billion ($36.15 billion) with new measures, scrapping plans to cut income tax and dropping a …

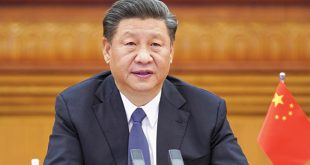

Read More »China seeks to boost stock market as Xi speech disappoints

Bloomberg Chinese regulators are ramping up efforts to support the stock market, which saw little reprieve from President Xi Jinping’s speech amid continued pressure from geopolitical tensions and the Covid Zero policy. A series of market-supporting measures are in the pipeline, including proposals to encourage companies to buy back shares and to ease curbs on short-term transactions by overseas …

Read More »Soaring dollar leaves food piled up in ports as world hunger grows

Bloomberg Food importers from Africa to Asia are scrambling for dollars to pay their bills as a surge in the US currency drives prices even higher for countries already facing a historic global food crisis. In Ghana, importers are warning about shortages in the run up to Christmas. Thousands of containers loaded with food recently piled up at ports in …

Read More »Kroger to buy rival grocery firm Albertsons for $24.6b

Bloomberg Kroger Co agreed to buy Albertsons Cos in a deal with an enterprise value of $24.6 billion that would create a US grocery giant with almost 5,000 stores and annual revenue of about $200 billion. Investors will receive $34.10 for each share in Albertsons, which includes a special dividend, the companies said in a statement. That reflects a …

Read More »Eurowings pilots to stage three-day strike over workload dispute

Bloomberg Pilots at Deutsche Lufthansa AG’s discount carrier will strike for 72 hours after Germany’s Vereinigung Cockpit union called Eurowings’ latest offer “completely insufficient.†The current dispute centers “exclusively†around a reduction of pilot workload and not pay for cockpit staff, according to a statement issued by the union. The employees “have no choice but to express their displeasure about …

Read More »Delta Airlines is free to resume share buybacks, but won’t: CEO

Bloomberg Delta Air Lines Inc. says it’s not interested in buying back shares anytime soon, even though pandemic-related restrictions have finally ended. “Our sole priority at Delta is to make sure that any excess cash that we’re generating is used to pay down debt, and we acquired a meaningful amount of debt during the pandemic,†Chief Executive Officer Ed …

Read More »Fast retailing rises after profit outlook tops projections

Bloomberg Uniqlo owner Fast Retailing Co rises the most in three months after the company issued an outlook for profit and sales for the current fiscal year ahead of analysts’ projections. Asia’s largest retailer is forecasting a record profit for the year ending August 2023, thanks to improving demand for its cheap casual apparel in Japan and a weaker …

Read More »Hong Kong airport traffic surges after hotel quarantine scrapped

Bloomberg Hong Kong International Airport’s September passenger traffic volume increased by 133% from a year earlier, after authorities scrapped some of the city’s harshest travel restrictions, including requirements for hotel quarantine and a pre-boarding Covid test. Passenger throughput climbed to 525,000, 10% higher than in August. The growth was boosted by visitors to and from Southeast Asia, the Airport …

Read More »Cost of candy soars by 13.1% in US

Bloomberg Giving out treats this Halloween will be a lot more expensive than usual. The cost of candy and chewing gum jumped 13.1% in September from last year, the most ever, according to US inflation data. This comes just before what’s arguably candy’s most important holiday — Halloween. The culprit is expensive sugar. US refined sugar prices have soared …

Read More »India’s rupee will endure dollar strengthening, says Sitharaman

Bloomberg The Indian currency will withstand the recent strengthening of the dollar, Finance Minister Nirmala Sitharaman said, reiterating a central bank forecast that the South Asian economy will grow at 7% in the year to March, 2023. “The Indian rupee has performed much better than many other emerging market currencies,†Sitharaman said at a media briefing in Washington DC. …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.