Bloomberg Maya, a financial technology firm in the Philippines, is considering raising about $150 million from investors to boost its growth, according to people familiar with the matter. The digital payments and banking company is working with financial advisers in a fundraising deal that could bring its valuation closer to about $2 billion, the people said, asking not to …

Read More »Banking

JPMorgan restricts staff’s use of AI-powered ChatGPT chatbot

Bloomberg JPMorgan Chase & Co has curbed its staff’s use of the ChatGPT chatbot, according to a person familiar with the matter. The artificial intelligence software is currently restricted, the person said, who asked not to be identified because the information is private. The move, which impacts employees across the firm, wasn’t triggered by any specific incident but reflects …

Read More »JPMorgan switches Chen to private wealth

Bloomberg JPMorgan Chase & Co’s Michelle Chen, a former senior China technology banker, will join the bank’s asset and wealth management division in Hong Kong, according to a memo seen by Bloomberg News. Chen, the bank’s former co-head of China technology, media and telecommunications, will lead the bank’s 23 Wall efforts in North Asia, reporting to Natacha Minniti, the …

Read More »Swedish housing showing signs of calming, says Riksbank chief

Bloomberg Sweden’s ailing housing market may be entering a calmer phase after being battered by rising interest rates and soaring costs of living, Riksbank Governor Erik Thedeen said. “If you look at some of the indicators, the decline may have subsided,†Thedeen said at a residential real estate conference in Stockholm. “Perhaps there are signs of some form of stabilisation …

Read More »HSBC eyeing special payout on Canada sale after Ping An battle

Bloomberg HSBC Holdings Plc will consider a special payout after the sale of its Canadian unit as the bank attempts to face down a campaign from its top shareholder to pursue a wider break-up of the business. Reporting fourth-quarter results that beat analyst estimates, HSBC said it may pay a special $0.21 dividend next year after the completion of the …

Read More »BOK to keep weighing interest rate increases

Bloomberg The Bank of Korea (BOK) said it will keep considering further interest-rate increases as inflationary pressures are expected to remain elevated for an extended period. The central bank said in a report to parliament on Tuesday that monetary policy needs to remain tight with a focus on reining in consumer prices. Even though inflation is likely to gradually …

Read More »Chinese banks hold rates as analysts bet easing to come

Bloomberg Chinese lenders followed the central bank by keeping their benchmark lending rates unchanged on Monday, with analysts expecting possible reductions in coming months to support the economic recovery. The one-year loan prime rate was held at 3.65% for a sixth consecutive month, in line with the forecasts from all 13 economists surveyed by Bloomberg. The five-year rate, a reference …

Read More »StanChart to hire up to 500 staff in Hong Kong

Bloomberg Standard Chartered Plc plans to hire 300 to 500 staff in Hong Kong this year, in anticipation of an increase in wealth management and lending as the city reopened its borders to mainland China. The lender expects “double-digit†growth in wealth management income and “single-digit†loan growth, according to a spokeswoman. The lender’s headcount in Hong Kong has …

Read More »BofA Securities joins Citigroup in turning bullish on Indian rupee

Bloomberg Bofa Securities Inc. is predicting more gains for the Indian rupee in the near term, joining Citigroup Inc., as the narrowest trade deficit in a year augurs well for the nation’s external finances. “The recent correction in rupee valuation and near-term improvement in current-account and capital flows tilt the risk-reward in favour of rupee appreciation,†Abhay Gupta, a strategist …

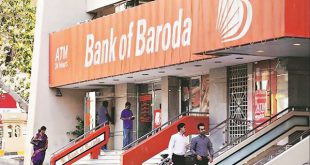

Read More »Bank of Baroda willing to keep lending to Adani group: CEO

Bloomberg One of India’s biggest state-backed lenders is willing to consider lending additional money to the beleaguered Adani group including for a project to remodel a slum that is among the world’s largest. Bank of Baroda will extend loans to the conglomerate if it meets the lender’s underwriting standards, said Sanjiv Chadha, chief executive officer and managing director, adding …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.