Abu Dhabi / Emirates Business A high-level delegation composed of representatives from the Ministry of Economy and the Council of Small and Medium-Sized Enterprises and Projects (SMEs Council), key businessmen and entrepreneurs, and other government officials, with a number of more than 50 persons, is set to visit Malaysia with the chief aim of exploring potential business and investment …

Read More »Admin

Veritas to guide on new European data regulation

Dubai / Emirates Business Veritas Technologies — the global leader in information management — has announced a set of solutions and services to help prepare organizations for the new European General Data Protection Regulation (GDPR) recently finalized by the European Union Parliament. Veritas Enterprise Vaultâ„¢ 12, Data Insight 5.1, Information Map and supporting services including the dark data assessment …

Read More »DMCA gears up to host Dubai Maritime Week

Dubai / Emirates Business Under the patronage of HH His Highness Sheikh Hamdan bin Mohammed bin Rashed Al Maktoum, Crown Prince of Dubai and Chairman of the Dubai Executive Council, Dubai Maritime City Authority (DMCA) — the government authority charged with regulating, coordinating and supervising all aspects of Dubai’s maritime sector — has announced that it has begun preparations to …

Read More »Dubai Silicon Oasis Authority takes the ‘happiest people’ initiative a step further

Dubai / Emirates Business Dubai Silicon Oasis Authority (DSOA) — the regulatory body for Dubai Silicon Oasis (DSO), the integrated free zone technology park — has announced fundamental changes to its ‘Happiest People’ initiative that was conceptualized in 2013, launched in 2014, and shaped into a comprehensive strategy in 2015. Inspired by the vision of His Highness Sheikh Mohammed …

Read More »JLL signs MoU to better transparency in Saudi real estate market

Emirates Business JLL — the world’s leading real estate investment and advisory firm — has signed a Memorandum of Understanding (MoU) with the Saudi Eastern Province Chamber of Commerce & Industry to improve transparency in the region’s residential, retail, office and hospitality real estate market. As an independent consultant, JLL will assist the Damman-based Chamber to improve the quality …

Read More »GE gets breakthroughs in Saudi ‘hot & harsh’ research to enhance productivity

Emirates Business GE (NYSE: GE) has achieved breakthrough results in Hot & Harsh technology development currently being undertaken in Saudi Arabia to identify localized solutions for enhancements in performance, availability and reliability against depleting factors such as temperature, dust, corrosion and fuel harshness. Research and development by a dedicated team from Power business, at the GE Saudi Technology & …

Read More »Iraq oil projects delay over spending cuts

Reuters International oil firms have warned Iraq that projects to increase its crude output will be delayed if the government insists on drastic spending cuts this year, a senior Iraqi oil official said. Oil companies helping Iraq develop its massive oil fields effectively perform a role similar to oil service firms in that they have to clear spending with …

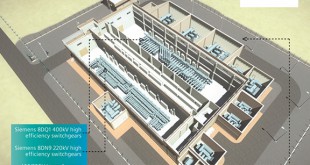

Read More »Landmark upgrade for Bahrain’s power grid

Emirates Business Siemens has been awarded a landmark contract to upgrade the Kingdom of Bahrain’s energy infrastructure with a new high-voltage power transmission network, strengthening the country’s electricity supply. The contract, awarded to Siemens by the Electricity and Water Authority (EWA) in Bahrain, was announced at an inauguration ceremony in Al Hidd in Bahrain. Siemens will introduce an upgraded …

Read More »Brexit campaign trail heats up for Leave, Remain camps

Bloomberg Britons eager to find out more about the pros and cons of European Union membership have a wealth of options this weekend, with campaigners for a “Leave†vote in next month’s referendum pledging a publicity “blitz†and their opponents promising “the biggest day of cross-party campaigning in U.K. political history.†Prime Minister David Cameron, opposition Labour Party leader …

Read More »Weakening UK data in shadow of Brexit puts pressure on Pound

Bloomberg After a week of warnings about the perils of Britain exiting the European Union, economic data next week may offer traders little reason to be bullish on the pound, the developed world’s worst-performing currency of 2016. For the period covering the June 23 referendum on EU membership, options traders are the most bearish on sterling since at least …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.