ABU DHABI/WAM

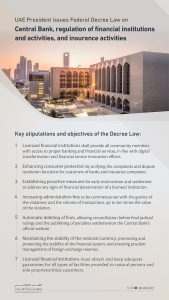

President His Highness Sheikh Mohamed bin Zayed Al Nahyan has issued Federal Decree Law No. (6) of 2025, regarding the Central Bank, and the regulation of financial institutions and activities and insurance activities. The Federal Decree Law is part of UAE’s continuous efforts to streamline the legislative and supervisory frameworks of the financial sector, enhance its stability and competitiveness and align the UAE’s financial ecosystem with the highest international standards. It is set to strengthen the Central Bank’s independence and vital role in ensuring financial and monetary stability.

The Federal Decree Law aims to maintain the stability of the national currency, promote and protect the stability of the financial system, and ensure prudent management of the Central Bank’s foreign reserves. It defines the principal functions of the Central Bank of the UAE, mainly to establish and implement monetary policy, organise and supervise licenced financial activities in line with international standards, and issue appropriate regulations and standards to ensure prudent and effective financial practices.

The Central Bank is also tasked with managing foreign reserves to cover the monetary base, supporting sustainable financing practices while integrating governance principles, monitoring and analysing regulatory risks, and developing and overseeing the infrastructure of financial markets.

In terms of customer protection and financial inclusion, the Federal Decree Law maintains that licenced financial institutions shall provide all community members with access to proper banking and financial services, in line with digital transformation and financial service innovation efforts. It establishes frameworks for the launch of national awareness campaigns, in collaboration with the financial sector and community outreach entities. The Federal Decree Law reaffirms previously established positive practices in terms of aligning credit facilities with customers’ income, in order to protect them from irresponsible practices.

It enhances the system of consumer protection and dispute resolution by unifying the complaints process for customers of banks and insurance companies under the independent entity “Sanadak”, responsible for receiving and settling complaints. It also provides for the establishment of specialised judicial committees to adjudicate disputes arising from financial activities, with the committees’ decisions being final and enforceable against licenced financial institutions for amounts up to AED100,000.

The Federal Decree Law outlines proactive measures for early intervention to address any signs of financial deterioration of a licensed institution in order to ensure financial stability and protection of customers. These measures include implementing recovery plans, imposing additional capital and liquidity requirements, making changes to the concerned institution’s business strategy, organisational and operational structures, appoint an interim committee or directly takeover the management of the institution, take steps for the merger, acquisition or liquidation of the concerned institution if necessary, and apply special measures on insurance companies failing to take the steps needed to rectify their position.

According to the Federal Decree Law, the Central Bank, as the “Resolution Authority”, plays a key role in managing financial crises. It has the power to remove and appoint the management of financial institutions, and recover monies from responsible persons.

It also has the power to appoint guardians tasked with managing the institution and its assets, terminate or close out contracts, transfer or sell assets and obligations, override rights of shareholders, restructure the capital, establish temporary entities to manage assets or continue providing key services, carry out an organised liquidation or bailout to ensure the continuity of critical functions.

In terms of administrative penalties, the Federal Decree Law stipulates raising the ceiling for administrative fines to be commensurate with the gravity of the violations and the volume of transactions. It allows the Central Bank to impose a proportional fine not exceeding ten times the value of the violation or unjust enrichment. The imposed fines shall be automatically debited from accounts of the violating person, held with the Central Bank or with any licenced financial institution.

The Central Bank may reach a reconciliation with the violating person, before a final judicial decision is made, and it may publish decisions related to such penalties on the official website of the Central Bank, to enhance market transparency and discipline.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.