Abu Dhabi / WAM Abu Dhabi Global Market (ADGM) and service company KPMG have come together to launch the first ever FinTech Abu Dhabi Innovation Challenge on October 22 in Abu Dhabi to enable start-ups to access industry-leading solutions that address emerging business challenges in the financial services industry. The Innovation Challenge, as part of the inaugural FinTech Abu Dhabi ...

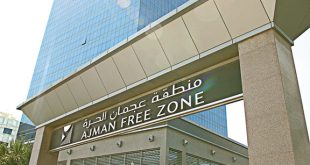

Read More »Ajman Free Zone eyes investments from five new global markets

Ajman / Emirates Business In a significant enhancement of its initiatives to attract investments into the UAE from global markets, Ajman Free Zone (AFZ), said that it has identified five new key markets where it will set up hub offices this year as part of its global investor outreach strategy. In a statement, AFZ said the expansion of the free ...

Read More »Abu Dhabi Ports gets ISO certification for business continuity management

ABU DHABI / WAM Abu Dhabi Ports, the master developer, operator and manager of commercial and community ports within the emirate of Abu Dhabi, in addition to the Port of Fujairah and the Khalifa Industrial Zone Abu Dhabi, has been awarded the ISO 22301 certification for its Business Continuity Management System (BCMS). The certification is a business continuity management benchmark, ...

Read More »Lootah Real Estate inks deal to build 1mn sqft of homes at Dubai South

DUBAI / WAM Lootah Real Estate has signed a deal with Dubai South to develop more than one million square foot of housing units at the site’s residential district. The agreement, which is a joint venture between Lootah Real Estate and Dubai South, will result in the construction of 1,150,548 sq ft of residential units over a number of phases. ...

Read More »Empower to showcase district cooling at green economy summit

DUBAI / WAM Emirates Central Cooling Systems Corporation (Empower), the world’s largest district cooling services provider, is to participate in the fourth edition of World Green Economy Summit (WGES 2017), organised under the patronage of HH Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, set to be held on October ...

Read More »Etisalat’s goodwill amounts to AED14.65bn in first half

Abu Dhabi / WAM Etisalat’s goodwill amounted to AED14.65 billion during the H1 of 2017 from AED14.09 billion during the corresponding period in 2016. The growth translates the company’s resounding success in keeping its eminent position as a leading entity at the communications sector, not only in the UAE only but also in the Arabian Gulf and Middle East region ...

Read More »DEWA calls for entries to Dubai solar show

DUBAI / WAM Dubai Electricity and Water Authority (DEWA) has invited companies involved in solar photovoltaic (PV) technology to participate in the second Dubai Solar Show; the region’s largest solar energy exhibition, organised by DEWA, in conjunction with the 19th Water, Energy, Technology, and Environment Exhibition (WETEX) 2017. Both events are organised under the directives of Vice President and Prime ...

Read More »Gulf Capital signs strategic partnership with EWS-WWF

ABU DHABI / WAM Gulf Capital, an Abu-Dhabi based alternative asset management company, announced a long-term ‘platinum’ corporate membership with Emirates Wildlife Society in association with WWF (EWS-WWF), the local environmental NGO which is committed to protecting the UAE’s natural heritage. As a platinum member, Gulf Capital will support EWS-WWF’s initiatives in the UAE, including marine and terrestrial conservation, environmental ...

Read More »Shams, Shurooq explore opportunities for growth

Sharjah / Emirates Business In the presence of Sheikh Sultan bin Ahmed Al Qasimi, Chairman of the Sharjah Media Council; HE Dr Khalid Omar Al Midfa, Chairman of the Sharjah Media City (Shams) met HE Marwan Bin Jassim Al Sarkal, CEO of Sharjah Investment and Development Authority (Shurooq), at the interim premises of Shams. The meeting was an occasion to ...

Read More »Next phase of FAB brand roll-out in H2

ABU DHABI / WAM First Abu Dhabi Bank (FAB), the UAE’s largest bank and one of the world’s largest financial institutions, has confirmed that the next phase of its brand roll-out will be launched during the second half of the year. During the coming months, the bank will start to install new FAB signage across First Gulf Bank and National ...

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.