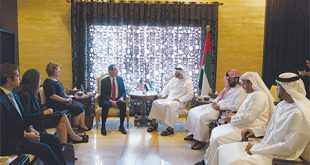

Abu Dhabi / WAM His Highness Sheikh Mohamed bin Zayed Al Nahyan, Crown Prince of Abu Dhabi and Deputy Supreme Commander of the UAE Armed Forces, received Steven Mnuchin, US Secretary of the Treasury, to discuss joint efforts to dry up sources of terrorism financing and take stock of the latest regional and global developments of mutual concern. Mnuchin is ...

Read More »International road congress, exhibition kicks off in Dubai

Dubai / WAM Under the patronage of Crown Prince of Dubai and Chairman of Dubai Executive Council His Highness Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, President of Dubai Civil Aviation Authority and Chairman and Chief Executive of Emirates Airline and Group His Highness Sheikh Ahmed bin Saeed Al Maktoum inaugurated the first International Road Federation (IRF) Middle East ...

Read More »Endowment firms play active role in meeting societies’ needs

Dubai / WAM His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, said that endowment establishments are key partners of the government in community development and play an active role in meeting societies’ needs. Sheikh Mohammed bin Rashid said that endowments are a development tool for communities and it ...

Read More »NBF wins ‘outstanding employer’ Mideast award

Fujairah / WAM The National Bank of Fujairah (NBF), has been awarded the accolade of ‘Outstanding Employer’ in the Middle East at the Korn Ferry Employee Engagement Awards. The award reflects the increased levels of engagement achieved over the last 7 years, which have led to improvements in the bank’s customer service and financial performance. NBF’s CEO, Vince Cook, said, ...

Read More »UAEU project to provide greater insight into Red Planet

Abu Dhabi / WAM Three Emirati students are being trained to support the UAE’s goal of unlocking the secrets to Mars, via a United Arab Emirates University (UAEU), project designed to provide greater insight into the Red Planet. The UAE Space Agency plans to send a probe, ‘Al Amal’ or ‘Hope’, to the Earth’s neighbouring planet, with the aim of ...

Read More »India-UAE Partnership Summit in Dubai to host 800 delegates

DUBAI / WAM Sultan bin Saeed Al Mansouri, Minister of Economy, and Dr Abdullah bin Mohammed Belhaif Al Nuaimi, Minister of Infrastructure Development, will lead a line-up of federal and state ministers from India and UAE at the inaugural two-day India-UAE Partnership Summit (IUPS), on October 30-31, at the Armani Hotel, Burj Khalifa, Dubai. Mohammed Sharaf Al Hashemi, Assistant Minister ...

Read More »Emirates to operate one-off A380 to Bahrain

DUBAI / Emirates Business Emirates will operate a special one-off A380 service to Bahrain on December 15, one day ahead of the country’s 46th National Day celebrations. On December 15, the Emirates A380 service will operate as EK 835 and EK 836, departing Dubai at 0055hrs and arriving in Bahrain at 0110hrs. The flight will then depart Bahrain at 0350hrs ...

Read More »Dubai Airports, Expo 2020 Dubai receive accolades

DUBAI / WAM Dubai Airports and Expo 2020 Dubai are leading the way in promoting world-class corporate wellness practices in the UAE, as the two government firms scooped top honours at the Daman Corporate Health Awards 2017, organised by MEED. Dubai Airports flew high on awards night winning two trophies. The corporate wellness team at Dubai Airports has been promoting ...

Read More »RAKBANK to offer ‘banking benefits’ to RAKEZ clients

Ras Al Khaimah / Emirates Business Ras Al Khaimah Economic Zone (RAKEZ) and RAKBANK, two of Ras Al Khaimah’s largest home-grown entities, have signed a Memorandum of Understanding (MoU) to offer the economic zone’s over 13,000 clients easy access to a wide range of banking services at preferential terms. The signing ceremony was held at RAKEZ headquarters in Ras Al ...

Read More »Gulftainer scoops corporate health and wellness award

SHARJAH / WAM Gulftainer, the world’s largest privately owned independent port operator, has won the ‘Corporate Health and Wellness Initiative’ category at the Daman Corporate Health Awards 2017. The company earned recognition for its corporate well-being programme, ‘Positive Pulse’, that seeks to enhance employee engagement by promoting a healthy lifestyle. In line with the efforts of the UAE’s Ministry of ...

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.