Dubai / Emirates Business Design Days Dubai, held under the patronage of His Highness Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai, and held in partnership with Dubai Culture & Arts Authority, wraps up its fifth edition as its most successful to-date. The Middle East and South Asia’s only collectable design fair was opened by HH …

Read More »Record Egypt stock rally stalls as traders cash in; Saudi gains

BLOOMBERG Egyptian stocks declined after investors locked in gains from the longest winning streak on record, ending a rally fueled by the biggest currency devaluation in more than a decade. Saudi Arabian shares rose. The EGX 30 Index dropped 0.3 percent at the close in Cairo, after rising for 11 straight days in the longest rally since Bloomberg started tracking …

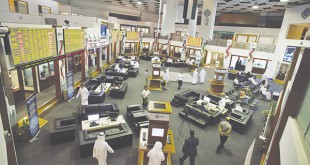

Read More »Emirates Securities Market Report down by -1.05 %

ABU DHABI / EMIRATES BUSINESS The Emirates Securities Market Index has decreased by -1.05% to close at 4485.89 points. Accordingly the Market Capitalization has lost AED 7.73 billion attaining AED 727.67 billion. A total of 1.04 billion Shares were traded with a total value of AED 1.3 billion during the trading session of 20-03-2016 through 11253 transactions. The number of companies which …

Read More »PBOC chief warns about rising debt

Beijing / Bloomberg People’s Bank of China (PBOC) Governor Zhou Xiaochuan sounded a warning over rising debt levels, saying corporate lending as a ratio to gross domestic product had become too high and the country must develop more robust capital markets. China still has a problem with illegal fundraising and financial services are insufficient, Zhou said in a speech at …

Read More »Banco Popolare CEO doesn’t rule out capital increase in M&A deal

BLOOMBERG Banco Popolare SC Chief Executive Officer Pier Francesco Saviotti is studying options including a potential capital increase to meet the European Central Bank’s (ECB’s) requests to back its planned merger with Banca Popolare di Milano Scarl. “Our capital is sound, but considering that we want to do the deal and that the ECB insists in taking actions to improve …

Read More »Santander opts tech-heavy board to reshape bank

Bloomberg Ana Botin, chairman of Banco Santander SA, has appointed a tech-heavy advisory board in a sign that information technology has become crucial to her growth plans at the Spanish lender. “I can’t think of a precedent where you’ve seen a panel of this nature,†says Julian Skan, a managing director at Accenture Plc in London who advises banks on …

Read More »Slippery banknotes become latest problem for British banks

Bloomberg As they grapple with shrinking profitability and the threat of a British exit from the European Union, the UK’s banks also face another challenge, slippery banknotes. Lenders from HSBC Holdings Plc to Royal Bank of Scotland Group Plc are working to upgrade or replace thousands of cash machines before the Bank of England starts to switch paper money with …

Read More »â€˜Helicopter money’: Fast moving on to European Central Bank’s radar

Frankfurt / AFP It’s a concept that conjures up images of European Central Bank (ECB) chief Mario Draghi donning his flying suit, starting his helicopter and flying out over the eurozone to throw money to the crowds below. In the question-and-answer session of his traditional post-meeting press conference last week, Draghi was asked whether “helicopter money†was part of the …

Read More »Kazakhstan goes to polls in parliamentary vote

Astana / AFP Citizens of energy-rich Kazakhstan went to the polls on Sunday in an early parliamentary election expected to provide a commanding majority for ageing autocrat President Nursultan Nazarbayev’s ruling Nur Otan party. Close to 10 million voters are eligible to cast votes in a ballot held early amid economic gloom in the Central Asian state and featuring six …

Read More »Pakistan province will celebrate Hindu holiday

Karachi / AFP Pakistan’s southern Sindh province has announced a public holiday to celebrate Holi next week, the first time the Hindu “festival of colours†will be officially marked in the overwhelmingly Muslim country. The move comes days after Pakistan’s federal parliament passed a non-binding resolution that called for the country to observe Hindu and Christian holidays. “We have announced …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.