Dubai / Emirates Business There are 183 hotel projects and 54,000 hotel rooms in the UAE pipeline, according to a new report. The hotel construction report by TOPHOTELPROJECTS prepared exclusively for The Hotel Show Dubai 2016 reveals that the majority of the new hotels are expected to open before 2020. The busiest years are forecast to be 2017 (56 …

Read More »Emirates Property Investment Company expands footprint

ABU DHABI / Emirates Business Emirates Property Investment Company (EPICO), the property and facilities management arm of Al Fahim Group, has announced the opening of its new office in Abu Dhabi. Located in the Mezzanine 1 level of Dalma Plaza, Hamdan Street, Abu Dhabi, the new office aims to cater to the growing demand for EPICO’s specialized leasing and property …

Read More »Dubai Properties launches Bellevue Tower 2

Dubai / Emirates Business In response to the strong market demand, Dubai Properties (DP), a leading Dubai-based real estate master developer and asset manager, has announced the launch of the second tower of Bellevue Towers for sale. The sought-after residential development has garnered huge investor interest and high customer demand after the iconic Bellevue Tower 1 was launched in …

Read More »Canon’s new superzoom cam

Emirates Business Canon Middle East, world leader in imaging solutions, on Tuesday introduces the PowerShot SX620 HS, a compact superzoom camera designed to get you closer to the action, thanks to a new 25x optical zoom. This stylish camera is perfect for capturing precious moments, when a smartphone snap simply won’t cut it, thanks to the 20.2 Megapixel CMOS …

Read More »Liwa festival drives up the taste for UAE dates

ABU DHABI / WAM Some 35 government and private companies have set up pavilions in the exhibition area of Liwa Dates Festival, promoting the latest trends and achievements in the business of dates. Among the active participants in the festival are: Al Dhafra, one of UAE’s largest dates company, which recently reported that the Emirates are now the world’s …

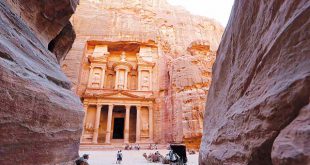

Read More »Israel, Jordan keen to cement ties

Jeddah /Â TNS Twenty-two years after the signing of the Israel-Jordan peace agreement, the Middle Eastern neighbours are eager to strengthen their relationship through a range of joint infrastructure ventures. Earlier this month a senior Israeli delegation led by Deputy Minister of Regional Cooperation Ayoob Kara met with Jordanian Prime Minister Dr. Hani Al-Muki and discussed closer cooperation on …

Read More »Economists expect Egypt’s central bank to hold rate

Reuters Economists expect Egypt’s central bank to keep rates unchanged at its monetary policy committee (MPC) meeting on Thursday, after it raised rates by 100 basis points at its last meeting. The central bank put up its key rates by 100 basis points to their highest level in years at its last MPC meeting on June 16, a move …

Read More »Kuwait starts applying new electronic media law

WAM Kuwaiti ministry of Information started the implementation of law No. 8/2016 to regulate electronic media, which was approved and published in the Official Gazette recently. The new law is to regulate all web-based publications including electronic news services, bulletins, websites of newspapers and televisions and the likes. Under the legislation, all these services must obtain a license from …

Read More »Saudi shipper Bahri Q2 net profit rises 47.2 pct

REUTERS National Shipping Company of Saudi Arabia (Bahri), the exclusive oil-shipper for Saudi Aramco, reported a 47.2 percent increase in second-quarter net profit on Tuesday. The company’s net profit for the three months to June 30 was 504.18 million riyals ($134.44 million), up from 342.48 million riyals in the same period a year earlier, it said in a bourse …

Read More »Kuwait Finance House Q2 posts 13.3 pc gain in profit

REUTERS Kuwait Finance House (KFH), the country’s biggest Islamic lender, reported a 13.3 percent rise in second-quarter net profit according to a statement on Tuesday, broadly in line with analysts’ forecasts. Net profit rose to 36.77 million dinars ($121.59 million) in the three months to the end of June, from 32.45 million dinars in the same period a year …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.