Bloomberg Russia increased its oil production in April thanks to a more generous Opec+ quota. The nation pumped 42.81 million tons of crude and condensate last month, according to preliminary data from the energy ministry’s CDU-TEK unit. That equates to 10.46 million barrels a day, or 1.9% more than in March. The data don’t provide a breakdown between crude and …

Read More »Exxon, Chevron preach prudence even as cash waterfall returns

Bloomberg Exxon Mobil Corp and Chevron Corp added momentum to a nascent recovery in the US oil industry as they reported bumper cash flow, a dramatic improvement after a torrid 2020. The energy giants generated enough cash to cover dividends, debt payments and project spending in the first quarter, the first time they’ve managed to do that in more than …

Read More »China’s Xi vows focus on emission cuts, end energy-inefficient projects

Bloomberg China will make cutting emissions a focus of its ecological strategy in the next five years, President Xi Jinping said, vowing to call off projects which consume a lot of energy and can’t meet environmental standards. “The carbon neutral and emission-peaking goals are solemn promises China has made to the world,†Xi said at a study session of the …

Read More »Covid-19: Lufthansa, Heathrow airport see delayed rebound

Bloomberg Deutsche Lufthansa AG reined in capacity plans and London’s Heathrow airport lowered passenger forecasts as new waves of coronavirus infections dent prospects for a travel rebound by the start of summer. Lufthansa now expects to offer only 40% of its pre-pandemic capacity for 2021 as a whole, according to a statement, a figure that’s below the level it has …

Read More »TSA extends face mask mandate for airplanes

Bloomberg Passengers on airplanes, buses and railroads in the US will have to keep wearing masks to guard against the spread of Covid-19 as federal officials extended a mandate that was set to expire within days through the busy summer travel season. The Transportation Security Administration (TSA) announced it was extending the mandate through September 13. The move is in …

Read More »â€˜Amazon to pass Walmart in US retail sales in 2025’

Bloomberg Amazon.com Inc will supplant Walmart Inc as the biggest US retailer by 2025, according to a new report, suggesting the e-commerce giant has too much momentum for Walmart to stop despite big investments in its own e-commerce offerings. By 2025, US shoppers will buy $632 billion worth of products at Amazon and retail afflilites including Whole Foods Market, surpassing …

Read More »Virgin Atlantic banks on UK travel plan to revive network

Bloomberg Virgin Atlantic Airways Ltd said places tipped to be on a UK list of destinations set to reopen from mid-May could bring back a significant portion of its pre-coronavirus business, shrinking losses this year. The US, Israel and the Caribbean accounted for 80% of Virgin Atlantic’s 2019 network and could all feature on the list set to be revealed …

Read More »Inflation haunts stock traders in blockbuster earnings season

Bloomberg Overflowing cargo ships, snarled production lines, copper above $10,000 and a start to earnings season that’s smashing records. As developed economies reopen and the newly vaccinated embrace their pre-Covid ways, the global rebound is proving vigorous but messy. For equity investors, the most pressing question is whether the return of inflation spoils returns and eats into corporate profits. Accelerating …

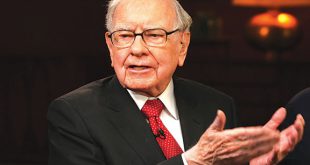

Read More »Buffett’s Berkshire gets more cautious on stocks, buybacks

Bloomberg Warren Buffett’s capital-deployment machine pulled back on several fronts at the start of the year as the billionaire took a more cautious stance on stocks. Berkshire Hathaway Inc’s net stock sales in the first quarter were the second-highest in almost five years and the conglomerate, where the billionaire is chief executive officer, slowed its buyback pace, according to a …

Read More »Oil demand in India drops as virus wave convulses nation

Bloomberg India’s Covid-19 crisis has pummeled demand for transport fuels to the lowest in several months, highlighting the risks for energy consumption amid an uneven global recovery from the pandemic. April sales of gasoline — used in cars and motorcycles — fall to 2.14 million tons to the lowest since August, according to preliminary data from officials with direct knowledge …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.