BLOOMBERGÂ

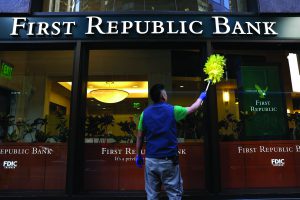

JPMorgan Chase & Co won the bidding to acquire First Republic Bank in an emergency government-led intervention after private rescue efforts failed to fill a hole on the troubled lender’s balance sheet and customers yanked their deposits.

JPMorgan will take over First Republic’s assets, including about $173 billion of loans and $30 billion of securities, as well as $92 billion in deposits.

JPMorgan and the Federal Deposit Insurance Corp (FDIC), which orchestrated the sale, agreed to share the burden of losses, as well as any recoveries, on the firm’s single-family and commercial loans, the agency said in a statement.

“Our government invited us and others to step up, and we did,†JPMorgan Chief Executive Officer Jamie Dimon said in a statement. “Our financial strength, capabilities and business model allowed us to develop a bid to execute the transaction in a way to minimise costs to the Deposit Insurance Fund.â€

The transaction makes JPMorgan, the nation’s largest bank, even more massive — an outcome government officials have taken pains to avoid in the past. Because of US regulatory restrictions, JPMorgan’s size and its existing share of the US deposit base would prevent it under normal circumstances from expanding its deposit base further via an acquisition.

And prominent Democratic lawmakers and the Biden administration have chafed at consolidation in the financial industry and other sectors. JPMorgan expects to recognise a one-time gain of $2.6 billion tied to the transaction, according to a statement. The bank estimated it will incur $2 billion in related restructuring costs over the next 18 months.

The $92 billion in deposits includes the $30 billion that JPMorgan and other large US banks put into the beleaguered lender in March to try to stabilise its finances. JPMorgan vowed that the $30 billion would be repaid.

For the $173 billion in loans and $30 billion in securities included in the deal, JPMorgan and the FDIC entered into the loss-sharing agreement to cover single-family residential mortgage loans and commercial loans, as well as $50 billion worth of five-year, fixed-rate term financing.

The FDIC and JPMorgan will share in both the losses and the potential recoveries on the loans, with the agency noting it should “maximise recoveries on the assets by keeping them in the private sector.†The FDIC estimated that the cost to the deposit insurance fund will be about $13 billion.

JPMorgan said even after the deal, its so-called common equity tier 1 capital ratio will be consistent with its first-quarter target of 13.5%. The transaction is expected to generate more than $500 million of incremental net income a year, the company estimated.

First Republic specialises in private banking that caters to wealthier people, much like Silicon Valley Bank, which failed in March, focussed on venture

capital firms.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.