Kiev /Â AFP Ukraine on Monday marked the third anniversary of the start of its pro-EU revolution with President Petro Poroshenko’s firm rejection of “the Russian world”. The so-called Euromaidan protests lasted three months and culminated in a bloodbath that claimed the lives of more than 100 largely unarmed people and about 20 anti-riot police. Poroshenko has declared November 21 …

Read More »TimeLine Layout

November, 2016

-

21 November

Turkey blocks EU MPs’ prison visit to Kurdish leader

Edirne / AFP Turkish authorities on Monday blocked a delegation of national and European Parliament lawmakers from visiting the leader of Turkey’s main pro-Kurdish party who has been held in jail for almost three weeks. The delegation of a dozen members of the Party of European Socialists (PES) sought to make a visit to the head of the Peoples’ …

Read More » -

21 November

Conference on industrial coop, supply chain today

Sharjah /Â WAM Encouraging Emirati businesses to not only manufacture, but become vital exporters as part of international supply chains, will be the topic at the Industrial Cooperation and Supply Chain Conference, to be held today at the Sharjah Exports Development Centre, SEDC, and organised by the Sharjah Chamber of Commerce and Industry (SCC). Under the patronage of H.H. Sheikh …

Read More » -

21 November

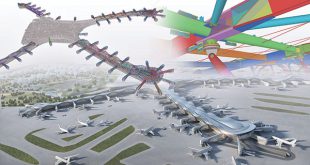

UAE projects world’s most innovative, least wasteful

Dubai / Emirates Business Legoland Dubai headlines UAE mega-projects that have been recognized as among the world’s most innovative, industry experts announced on Monday ahead of The Big 5 construction exhibition. One of the world’s most attractive construction markets, the UAE hosts a robust construction pipeline of more than US$700 billion, over one-third of the GCC’s pipeline, according to …

Read More » -

21 November

UAE Exchange opens ‘women-powered’ branch at DAFZA

Dubai / Emirates Business UAE Exchange, the leading global remittance, foreign exchange and payment solutions brand, unveiled its first ever “women-powered†branch at the Dubai Airport Free Zone (DAFZA), UAE. This is a first-of-its-kind initiative in the UAE by any exchange house and is also in line with the vision of the UAE Federal Government in bringing gender equality. …

Read More » -

21 November

Beauty salons in Dubai told to install ‘e-Cashier’

Dubai / Emirates Business The Commercial Compliance & Consumer Protection (CCCP) sector in the Department of Economic Development (DED) has asked all beauty salons in Dubai to install automated cash registers by the end of February 2017. The campaign, named ‘e-Cashier’ is aimed to enhance transparency and protect consumer rights, and follows a growing number consumer complaints on price …

Read More » -

21 November

Dubai Holding, Reem Mall join hands to bring new retail offering to Abu Dhabi

Abu Dhabi / Emirates Business Reem Mall, Abu Dhabi’s upcoming fashion, entertainment and dining destination in the heart of Abu Dhabi, announced on Monday that it has signed terms of agreement with Dubai Holding Group. Commenting on the latest development for the much anticipated US$1bn project, Shane Eldstrom, Chief Operating Officer for Reem Mall said: “We are pleased to …

Read More » -

21 November

Dubai FDI briefs Japan investors on emirate’s business potential

Dubai / Emirates Business Dubai Investment Development agency (Dubai FDI), an agency of the Department of Economic Development (DED), recently visited Japan, meeting with business representatives, investors and investment facilitators and updating them on the opportunities in Dubai. “The growing emphasis on sustainability, competitiveness, smart technologies and happiness across development initiatives in Dubai presents significant opportunities for taking UAE-Japan …

Read More » -

21 November

DAFZA holds grad ceremony of ‘Double Up 3M’ programme

Dubai / Emirates Business The Dubai Airport Freezone Authority (DAFZA) held a Graduation Ceremony for the first batch of its participants of Double Up 3M corporate accelerator program launched last September. The pioneering program was created especially for DAFZA customers to help accelerate business growth and develop their companies, in line with the Freezone’s commitment to make innovation a …

Read More » -

21 November

Sobha unveiles new land plots for investors within Sobha Hartland

Dubai / Emirates Business Sobha Group, one of the Middle East’s leading premium real estate developers, has unveiled new land plots for investors within Sobha Hartland – the only fully integrated freehold community on the Dubai Water Canal and in Mohammed Bin Rashid Al Maktoum City. To meet the interest generated from last week’s inauguration of the Dubai Water …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.