Emirates Business The new Mercedes-Benz SLC (previously SLK) takes the roadster’s driving pleasure to a new level thanks to an unrivalled combination of sportiness and comfort. Just in time for the 20th birthday of its segment, the archetypal compact roadster enjoys a new evolution — with a new name, optimised technology and an enhanced look. Comprehensively refined, and with …

Read More »Blog Layout

‘Clean’ Tesla depends on where you are

Bloomberg How much cleaner are electric cars than the fossil-fuel powered alternative? The answer depends on exactly where you charge the batteries. In places that use low-carbon energy sources like renewables and nuclear, electric vehicles dramatically reduce emissions. There’s less of a difference in regions where most of the power comes from coal, like China. While an electric vehicle …

Read More »Digitisation set to transform automotive aftermarket

Dubai / Emirates Business More than 100 professionals of the Middle East’s automotive aftermarket gathered in Dubai to discuss the future trends in their industry, with the rise of digitisation likely to have a major impact on the way they do business in the region. Valued at US$367 billion in 2015, the global market for replacement parts is estimated …

Read More »Legoland, Riverland to open on October 31

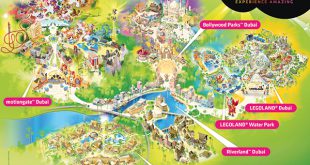

Dubai / Emirates Business Dubai Parks and Resorts, the region’s largest integrated theme park destination, announced on Thursday that it will now open on October 31 with LEGOLAND® Dubai and Riverlandâ„¢ Dubai, the retail dining and entertainment district. Bollywood Parksâ„¢ Dubai, LEGOLAND Water Park and the Lapitaâ„¢ Hotel will open to the public on November 15 while MOTIONGATEâ„¢ Dubai …

Read More »Gulf Craft to start megayachts manufacturing

Emirates Business Gulf Craft has announced plans to start manufacturing megayachts (yachts larger than 50 meters in length) marking the Emirates-based builder’s entry into the exclusive league of global megayacht manufacturers. The announcement was made at the Monaco Yacht Show, where Gulf Craft revealed the riveting new concept designs for the 61-meter Majesty 200 and the 53-meter Majesty 175, …

Read More »Kalba Bird of Prey Centre to launch live shows

Sharjah/ Emirates Business The Kalba Bird of Prey Centre, operating under the umbrella of the Environment and Protected Areas Authority (EPAA) in Sharjah, is excited to announce the launch of its entertainment shows for the winter season. The shows will be fun for all members of the family and will offer a unique jaw-dropping experience with live demonstrations of …

Read More »du wins MoE award for tapping Emirati talent

DUBAI / Emirates Business The Ministry of Economy recognised du as a pioneer in training and qualifying Emirati nationals in the profession, either for employees or the community with an award for The Emiratis in the Accounting, Auditing and Financial Management professions. du representatives, Amer Kazim, Chief Financial Officer, and Mohamad AlSaabri, Senior Director for National Development, received the …

Read More »Iraq’s OPEC revolt shows Saudi-Iran oil deal fragility

ALGIERS / Reuters For years, debates in the OPEC conference room were dominated by clashes between top producer Saudi Arabia and arch-rival Iran. But as the two managed to find a rare compromise on Wednesday— with Riyadh softening its stance towards Tehran— a third OPEC superpower emerged. Iraq overtook Iran as the group’s second-largest producer several years ago but …

Read More »Oil holds near $47 after OPEC agrees first output cut in 8 years

Bloomberg Oil held near $47 a barrel after advancing the most since April as OPEC agreed to reduce production for the first time in eight years, surprising traders who had expected members to maintain output. Futures slipped 0.5 percent in New York after surging 5.3 percent Wednesday. The Organization of Petroleum Exporting Countries agreed to cut production to a range …

Read More »OPEC deal lifts more than oil, drives gains across commodities

Bloomberg OPEC’s surprise deal to reduce crude production isn’t only supporting oil prices, it’s helping drive gains across commodities and the companies that produce them. The Bloomberg Commodity Index, a measure of returns from 22 raw materials, extended gains after the biggest jump in almost three weeks on Wednesday, when OPEC agreed to cut output for the first time …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.