Bloomberg Goldman Sachs Group Inc. was half right about what it expected to happen with a more dovish-sounding Federal Reserve. But that didn’t save its US dollar trade — so it’s trying a different tactic. The firm’s recent recommendation to short the US Dollar Index (DXY) hit its stop — the level at which a trade is halted so losses …

Read More »Blog Layout

Fed officials emphasize March pause amid strategy rethink

Bloomberg The policy shift under way at the Federal Reserve will affect new forecasts to be published later this month and also their longer-run strategy. Recent remarks by Chairman Jerome Powell, Vice Chairman Richard Clarida, Governor Lael Brainard and New York Fed President John Williams have all signalled their contentment with letting the policy rate rest at 2.25 percent to …

Read More »Deutsche Bank makes deep cuts to 2018 bonuses

Bloomberg Deutsche Bank AG employees learned what bonuses they would receive, with many facing deep cuts and some bankers in New York and London receiving zero payouts, people with knowledge of the decisions said. Many of those who avoided large cuts to their 2018 rewards did so because they had guaranteed payouts, such as recent hires, the people said, asking …

Read More »Nordic laundering response brings bigger fines, prison

Bloomberg Hit by a money-laundering scandal involving their biggest banks, Nordic policy makers are stepping up the region’s defenses. Here is a list of actions and proposals made by governments and financial watchdogs across the Nordic countries. DENMARK Denmark has said it wants to implement some of Europe’s toughest anti-money laundering rules. Since the Danske Bank A/S scandal erupted last …

Read More »BOE’s Saunders sees no rush to hike interest rates as Brexit fog persists

Bloomberg The Bank of England doesn’t need to rush to raise interest rates until the uncertainty of Brexit lifts, according to policy maker Michael Saunders. In a speech in London, Saunders, considered one of the most hawkish members of the Monetary Policy Committee, said that tame inflation and a slowdown in growth meant officials could adopt a wait-and-see approach as …

Read More »South Africa central bank seeks lower inflation

Bloomberg South Africa’s central bank wants to see sustainably lower inflation to ensure cheaper borrowing costs in the economy, Governor Lesetja Kganyago said. “We have indicated that a consistently lower rate in the near term, at the midpoint of our target band — 4.5 percent — would lower long-term interest rates and be more supportive of balance in the economy,†…

Read More »Europe’s taxpayers may pay the price for Airbus A380’s demise

Bloomberg The biggest losers in Airbus SE’s decision to wind down production of its A380 superjumbo may be taxpayers in France, Germany, Spain and the UK, where governments made a big bet on the plane by lending more than 3.3 billion euros ($3.7 billion) to build it. Airbus agreed to reimburse the loans, together with interest, but payments were tied …

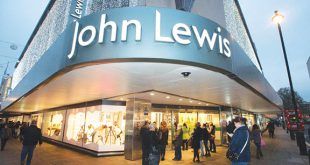

Read More »John Lewis cuts bonus as UK retail crisis deepens

Bloomberg UK retailer John Lewis Partnership Plc cut employee-owners’ annual bonus to the lowest level in more than half a century, underlining the depths of the crisis in the country’s shopping districts. The operator of department-store chain John Lewis and grocer Waitrose said it cut the bonus to reduce debt, maintain investment and retain cash as it wrestles with uncertainty …

Read More »Global air freight market makes weak start to 2019

Emirates Business The International Air Transport Association (IATA) released data for global air freight markets showing that demand, measured in freight tonne kilometers (FTKs), decreased 1.8% in January 2019, compared to the same period in 2018. This was the worst performance in the last three years. Freight capacity, measured in available freight tonne kilometers (AFTKs), rose by 4.0% year-on-year in …

Read More »Ethiopian Air en route to Nairobi crashes, killing all

Bloomberg A four-month-old Ethiopian Airlines Boeing plane en route to Kenya’s capital, Nairobi, crashed on Sunday, killing all 149 passengers and eight crew, the airline said in a statement. The crash is the second in five months involving a Max 8 after a Lion Air plane that had been delivered only 2 1/2 months earlier nose-dived into the Java Sea …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.