The Obama administration’s Clean Power Plan was never the best way to lower US greenhouse-gas emissions. A national tax on carbon dioxide emissions would have been far simpler and more effective. By making sure that all fuels are priced to account for their effects on climate, it would have let the market find the most efficient ways to cut emissions. …

Read More »Opinion

Angela Merkel wins despite disappointing everyone

By accepting an upper limit to the number of immigrants Germany will accept for humanitarian reasons, German Chancellor Angela Merkel made one of her trademark compromises: no one is happy, but her solution will work well enough for now. Forming a governing coalition in the next few months will require a few more of these. Merkel and Bavarian prime minister …

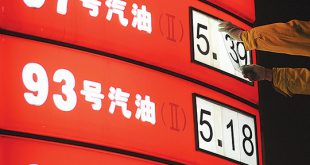

Read More »Higher oil prices may not be so temporary

Oil prices have been subject to big swings this year. Since June, though, fundamental demand factors have been supportive, and with global economic growth firming, the outlook for oil is bright. The significant — and surprising — midyear crude oil price selloff was triggered at the beginning of June by China’s Caixin PMI for May, which showed a contraction in …

Read More »Driverless cars give engineers a fuel economy headache

Judging from General Motors Co.’s test cars and Elon Musk’s predictions, the world is headed toward a future that’s both driverless and all-electric. In reality, autonomy and battery power could end up being at odds. That’s because self-driving technology is a huge power drain. Some of today’s prototypes for fully autonomous systems consume two to four kilowatts of electricity—the equivalent …

Read More »Yes, build the wall!

It’s time to build the wall—and, in doing so, prevent an estimated 690,000 DACA ‘dreamers’ from being deported from the United States. It’s a fair deal that could be scuttled only by intense and self-serving partisanship from the White House and the Republican and Democratic congressional leadership. As almost everyone knows by now, DACA stands for ‘Deferred Action for Childhood …

Read More »Does Italy have Catalonia solution

Spanish Prime Minister Mariano Rajoy showed that he doesn’t merely hold a better poker hand than Catalan leader Carles Puigdemont; he’s also the better player. Unfortunately, the Catalan separatism problem won’t be resolved by this particular game. At some point, Spain will need to offer Catalans an arrangement with which they can live. An example of a potentially acceptable arrangement …

Read More »The real reasons global bond yields are so low

The general perception is that global bond yields are historically low because monetary policy has been aggressively eased. This leads to expectations that yields will rise—possibly sharply—once the Federal Reserve and the European Central Bank start the process they call “balance sheet normalization.†After all, when he was Fed chairman, Ben S. Bernanke spent a lot of time and effort …

Read More »Africa’s economic future depends on its farmers

When the economies of Nigeria and South Africa recently rebounded, it wasn’t oil or minerals that did the trick. It was agriculture. Faster and more sustainable agricultural growth is crucial not only to the continent’s economy, but also to its ability to feed and employ its surging population. Agriculture still accounts for a quarter of gross domestic product and as …

Read More »It’s Denmark model versus Singapore for growth crown

Communism is officially dead. North Korea, the last holdout of the 20th-century Soviet-style central planning, is moving towards a hybrid economy. David Volodzko in a Bloomberg View op-ed reports: Economic reforms made in 2011 have begun to take hold, allowing factory managers to set salaries, find their own suppliers, and hire and fire employees. Farming collectives have been replaced by …

Read More »A remarkable run for stocks gets more extraordinary

With a 2 percent gain in September, the S&P 500 Index has set a record: positive returns in each of the first 10 months of the year. There’s never been a full calendar year when this has happened every month. Going back to November 2016, the index has ripped off 12 consecutive monthly gains. The S&P hasn’t had a down …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.