Thumbing through the annual report of the White House’s Council of Economic Advisers (CEA) is always an education. This year’s 430-page edition is no exception. Crammed with tables and charts, it brims with useful facts and insights. —On page 62, we learn that the growth of state and local government spending on services (schools, police, parks) has been the slowest …

Read More »Opinion

G20 does little to remedy global economy

G20 finance ministers’ disagreement in Shanghai over the best way to stem the economic slowdown had a cascading effect across the universe as hopes pinned on the summit dashed, sending a negative message to the equity markets. Despite being aware about the potential risks, the group’s communiqué did not include the call for coordinated action for which many had hoped. …

Read More »Why deflation threat hasn’t gone away

A jump in the core U.S. inflation rate has persuaded many people that deflation is no longer a threat. But even those who never subscribed to the idea that consumer prices might decline for a sustained period should be wary of misreading the data and dismissing the risk of deflation. Core U.S. consumer prices, excluding food and energy, rose 0.3 …

Read More »Is Singapore headed for a recession?

There is uncertainty over whether Singapore’s economy is headed for a recession, and the online debate certainly reflects that. Overall, there seems to be a general consensus that growth prospects in 2016 will be challenging. As the island-state’s largest export destination, China’s slowing economy is set to be a drag on Singapore’s growth prospects. According to several observers, including Swiss …

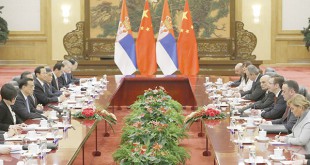

Read More »China’s growing ties with Serbia

On February 5, 2016, Chinese President Xi Jinping made an official statement acknowledging Serbian statehood day. In the press release that followed, Xi highlighted deepened cooperation between China and Serbia in recent years, and reaffirmed China’s intentions to expand economic links with Serbia in the years to come. This statement came on the heels of announcement by Chinese ambassador to …

Read More »EU must recognize Kosovo, or pay a heavy price

Eight years after Kosovo declared its independence from Serbia, five European Union states still refuse to recognize it. They need to relent. They are contributing to an economic and security sinkhole in the heart of the Balkans — and if history is any guide, that’s a bad idea. During a chat with Kosovo’s Prime Minister Isa Mustafa as he passed …

Read More »How to cool down Donald Trump

“Hell,†said Alabama’s Democratic Gov. George Wallace before roiling the 1968 presidential race, “we got too much dignity in government now, what we need is some meanness.†Twelve elections later, Wallace’s wish is approaching fulfillment as Republicans contemplate nominating someone who would run to Hillary Clinton’s left. Donald Trump, unencumbered by any ballast of convictions, would court Bernie Sanders’ disaffected …

Read More »PPPs will boost public sector infra

There has been a growing interest in public-private partnerships (PPPs) worldwide in recent years, being a popular way of procuring public-sector infrastructure. This alliance is gaining momentum at a time regional economies face increasing budgetary pressures resulting from the weaker price of oil. Most examples of successful PPPs are in transportation, housing, roads, public parks and others. So the PPPs …

Read More »China’s South China Sea behaviour worrying

Foreign ministers from the ten Southeast Asian countries said Saturday that they were “seriously concerned†by recent developments in the South China Sea. China’s assertiveness in the South China Sea has shown few signs of easing, with Beijing positioning a surface to air missile system on Woody Island, one of the disputed Paracel Islands in the northern half of the …

Read More »China’s battle to regain economic control

In a battle against declining economic outcomes, China is attempting to regain a semblance of control by changing existing policies and halting pessimistic statements in the media. The task is overwhelming and endless, as new measures appear to have little effect in the face of declining growth, capital flight, and rising anxiety. Still, Beijing is fighting a downturn on several …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.