The planet’s wealthiest and most powerful countries face a slow-moving but potentially devastating political and economic crisis. It now falls to Donald Trump to find a way to combat it. Over the past few years, voters in much of the developed world have rebelled against the establishment. In the U.S., millions of voters supported an avowed socialist in the …

Read More »Opinion

Waste management needs to be innovative

Rapid urbanization and industrialization coupled with the galloping population is posing a massive waste problem. The trash generated in our cities is becoming increasingly difficult to manage. A recent study by Frost and Sullivan indicates that the volume of total garbage in the GCC will go up from 94 million MT in 2015 to 120 million annually by 2020. …

Read More »UK shouldn’t weaponize its overseas aid budget

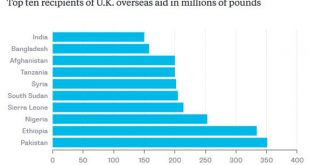

As the UK begins the long, difficult process of building a post-Brexit trade architecture with the rest of the world, the government may be tempted to mobilize the country’s overseas aid budget in support of those efforts. While there’s nothing wrong with hoping that assisting poorer countries will make them economically strong enough to engage in increased trade, the …

Read More »Bank of Japan shuts down its monetary laboratory

Japan’s great monetary policy experiment is drawing to a close, and the results may change the way the world thinks about central banking. The Bank of Japan’s recent quarterly report says, in effect, that the central bank has done all it can do to raise growth and inflation, and that fiscal policy needs to step in and help. The …

Read More »As China conquers Everest, tourists are big winners

Adam Minter China has big plans for Mount Everest. Although the south-facing side of the mountain, in Nepal, might be better known, the Tibetan north face also has a rich mountaineering history, and China has outlined an ambitious new vision for commercializing it. That may sound like an unseemly approach to the world’s tallest and most forbidding peak. But …

Read More »A disruptive yet ruinous triumph for the GOP

At dawn on Tuesday in West Quoddy Head, Maine, America’s easternmost point, it was certain that by midnight in Cape Wrangell, Alaska, America’s westernmost fringe, there would be a loser who deserved to lose and a winner who did not deserve to win. The surprise is that Barack Obama must have immediately seen his legacy, a compound of stylistic …

Read More »US liberals should take comfort from rest of us

Welcome, American liberals. Welcome to the special torment of discovering that you do not know your country. You thought, no doubt, you were exempt — immune from the shocks that liberals throughout the world have felt in recent years. And I can understand why: Because while you have suffered defeats at the hands of Reagan and the Bushes, and …

Read More »Trump’s duty to unite and lead Americans

Donald Trump has made history as the first man with no government experience to reach the highest office in the land — and as the least popular and most divisive candidate ever to do so. The burden is now on him to leave a mean-spirited campaign behind and demonstrate that he can bring people together to move the country …

Read More »Climate diplomats must get down to business

Climate diplomacy is becoming a core element of global negotiations and business propositions around the world. With Donald Trump’s stunning victory, the role of climate diplomats has assumed more significance. Even as the US election sends shivers down the spine of many environmentalists, climate diplomats have got down to brass tacks in Marrakech to decide on the rulebook to …

Read More »How Trump could help the Federal Reserve

Everyone has a lot to digest in the wake of Donald Trump’s presidential victory, but for markets one question looms large: What should it change in the policies of the world’s most powerful central bank, the U.S. Federal Reserve? The answer differs depending on whether you’re looking at the next few months or the next several years. In the …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.