Singapore / Bloomberg The recent drubbing in Singapore bank stocks is turning Southeast Asia’s biggest lenders into bargains for money managers including Aberdeen Asset Management Plc. DBS Group Holdings Ltd. lost S$3.6 billion ($2.7 billion) in market value in seven days from July 28 when its client Swiber Holdings Ltd. signaled it was in financial trouble. DBS’s two smaller …

Read More »Banking

Kenyan lawmakers escalate battle against banks to cap rates

Bloomberg Kenyan lawmakers are threatening to overrule President Uhuru Kenyatta if needed to force the country’s banks to lower their lending rates. The country’s parliament on July 28 approved a bill that will limit the amount of interest banks can charge on loans, with the proposal only needing Kenyatta’s signature to become law. The proposals jolted lenders into signing …

Read More »HSBC executives get leadership roles at Bradesco

La Paz / AFP Banco Bradesco SA, Brazil’s second-biggest bank by market value, named former executives of HSBC Holdings Plc’s local unit to new leadership positions as its acquisition of the business last month expands the investment-banking team 20 percent. Ricardo Lanfranchi, former head of Brazil equity sales for HSBC, is now global head of equities and derivatives for …

Read More »IMF sees ECB focus on more asset buying

Bloomberg The European Central Bank may need to rely more on asset purchases for monetary stimulus as its negative interest rates approach the limit of their effectiveness, economists at the International Monetary Fund (IMF) said. While negative rates in the euro area have successfully eased financial conditions for banks and their customers — spurring a modest credit expansion that supports …

Read More »Kiwi soars to one-year high

Bloomberg New Zealand’s dollar surged to the highest level since May 2015 after traders deemed the central bank’s decision to cut borrowing costs was insufficiently dovish amid the global ardor for yield that’s been spurred by unprecedented global monetary easing. The Aussie and kiwi dollars have gained at least 0.5 percent this month as their central banks reduced benchmark …

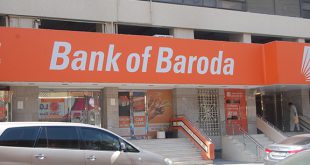

Read More »Bank of Baroda falls most in 3 months

Mumbai / Bloomberg Bank of Baroda, India’s second largest state-run lender by assets, fell the most in almost three months after surging bad-loan provisions dragged first-quarter profit lower. Shares of Baroda fell 8.3 percent, the biggest intraday drop since May 16, to 147.15 rupees as of 12:20 p.m. local time. The stock has lost 6 percent this year, compared …

Read More »BOK holds key rate at record low

Bloomberg South Korea’s central bank held its key interest rate at a record low as board members deferred further policy action until they have a clearer picture of the economy’s path. The decision to keep the seven-day repurchase rate at 1.25 percent was forecast by all 19 economists surveyed by Bloomberg. All seven board members agreed on the decision, …

Read More »Turkish banks obey Erdogan’s calls to slash interest

Bloomberg Turkey’s banks are taking their orders from the top. At least seven lenders in the country announced they’d slashed interest charges on mortgage loans after President Recep Tayyip Erdogan said resistance to lower borrowing costs could be ” treason.” The remarks were the harshest yet from Erdogan, who’s been pushing the nation’s central bank for several years to …

Read More »Oz’s Commonwealth Bank posts US$7.8 billion profit

Sydney / AFP Australia’s biggest lender Commonwealth Bank sounded a cautious note about the country’s economic outlook on Wednesday even as it posted a record Aus$9.23 billion (US$7.08 billion) in annual profit. The Commonwealth Bank’s performance is closely watched for guidance on the health of the Australian economy in the current low interest-rate environment. CBA chief executive Ian Narev …

Read More »UK Cameroon bank workers accused of massive theft

Douala / AFP Four employees of a Cameroon bank have been detained on suspicion of stealing millions of euros, sources said. The four staff members of BICEC, a local subsidiary of French bank BPCE, have been placed in detention in the economic capital Douala after they were arrested, a legal source said on condition of anonymity. The group, which …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.