Bloomberg Before an elite financial and business audience, Italy’s prime minister and finance minister strove to project optimism that their drive to overhaul the country’s troubled banks will succeed. But a fellow guest from the European Central Bank damped expectations with a warning the market could have the last word. The restructuring of Banca Monte dei Paschi di Siena …

Read More »Banking

Deutsche Bank CEO weighs drastic steps as revamp sputters

Bloomberg John Cryan is going back to the drawing board after Deutsche Bank AG lost more than half its market value since he unveiled his overhaul last year. The chief executive officer and his top managers will meet this weekend to assess progress on the reorganization, said a person familiar with the matter. Deutsche Bank held talks over a …

Read More »ICBPI hires UniCredit’s top official as CFO

Bloomberg Istituto Centrale delle Banche Popolari Italiane (ICBPI) SpA, the Italian banking-services provider owned by private-equity firms, hired Bernardo Mingrone from UniCredit SpA as chief financial officer, according to people with knowledge of the matter. Mingrone will reorganize and develop ICBPI to prepare for a direct sale or a listing in the next three years, said one of the …

Read More »Cryan calls for bank mergers after Commerzbank pact

Bloomberg Deutsche Bank AG Chief Executive Officer John Cryan urged more consolidation among European banks struggling to shore up profitability, after his own firm held talks with its biggest German rival earlier in August about a possible deal. “We need more mergers, at a national level but also across national borders,†Cryan said at a conference hosted by Handelsblatt …

Read More »UK banks slammed for elitism as study shows shoe colour counts

Bloomberg The British investment-banking industry is underpinned by entrenched elitism that blocks people from lower-income backgrounds winning jobs on the basis of ability, according to a report by a government advisory body. Recruiters seeking polished candidates who speak and dress a certain way often discriminate against applicants on the basis of details including shoe color and where they went …

Read More »Deutsche Bank gains in Frankfurt trading

Bloomberg Deutsche Bank AG extended gains in Frankfurt trading on a report Germany’s largest bank considered the sale of all or part of its asset management business as it explores strategic options to revive profit. While small parts of the asset management division could be sold, executives at the bank are keen to hold on to most of the …

Read More »Bank of China posts US$6.9 billion profit

Bloomberg Bank of China Ltd., the nation’s fourth-largest lender, reported a 3.4 percent increase in second-quarter profit even after setting aside extra provisions to boost its bad-loan buffer. Net income rose to 46.4 billion yuan ($6.9 billion) in the three months ended June 30, from 44.9 billion yuan a year earlier, according to figures derived from first-half numbers released …

Read More »Europe bankers see $2.5bn of bonuses vanish in stock rout

Bloomberg Investment bankers at Europe’s biggest securities firms are watching their bonuses melt. A rout in financial stocks this year has wiped more than $2.5 billion from the value of deferred shares that were paid as bonuses in the past few years at Barclays Plc, Credit Suisse Group AG, Deutsche Bank AG and UBS Group AG, data compiled by …

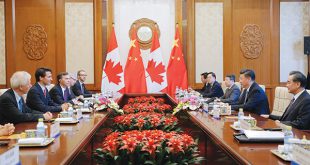

Read More »Canada keen to join China-backed AIIB

Beijing / AFP Canada will apply to join the China-backed Asian Infrastructure Investment Bank (AIIB), Ottawa’s finance department said on Wednesday, in a coup for Beijing after Washington had tried to dissuade US allies from signing up. “Canada is always looking for ways to create hope and opportunity for our middle class as well as for people around the …

Read More »Australia to probe big banks’ practices

Bloomberg Australia’s government will probe bank lending to small businesses as Prime Minister Malcolm Turnbull tries to stave off opposition calls for a broader inquiry into the financial industry. The inquiry, to be conducted by the Small Business and Family Enterprise Ombudsman, comes on top of moves to summon chief executives of the nation’s big four banks to testify …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.