London / AFP Almost three quarters of British bankers believe London will still be the financial centre of Europe in five years’ time, despite risks surrounding Brexit, according to a study published Wednesday. US financial services firm Synechron, which carried out the research with the TABB Group, said it questioned 80 capital markets executives in banks based in Britain. …

Read More »Banking

OCBC cites compliance burden as reason to grow private bank

Bloomberg Oversea-Chinese Banking Corp.’s Chief Executive Officer Samuel Tsien said surging compliance costs are one factor spurring him to expand his Asian wealth-management business, at a time when some overseas competitors are retreating. That’s because the rapidly expanding costs of complying with anti-money laundering, tax-compliance and other regulatory requirements — rising by 35 percent annually across the whole bank …

Read More »BOJ delays inflation goal in blow to ‘Abenomics’

Tokyo / AFP Japan’s central bank on Tuesday again pushed back the timeline for hitting its inflation goal, the latest policy change that has raised questions about its attempt to revive the deflation-plagued economy. The Bank of Japan (BOJ) has for more than three years embarked on a bond-buying stimulus programme to try to keep interest rates ultra-low and …

Read More »RBA keeps interest rates steady

Sydney / AFP Australia’s central bank on Tuesday held interest rates at a record low of 1.50 percent and indicated what analysts called a “wait and see” approach to future monetary policy easing despite a run of soft inflation figures. The country is transitioning away from a resources investment boom that has helped the economy mark a quarter of …

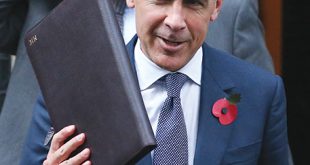

Read More »BOE boss Carney to stay until 2019

London / AFP Bank of England (BOE) governor Mark Carney put an end to speculation over his future by announcing he would extend his contract for one year to 2019 to help secure an “orderly transition” to Brexit. The Canadian will not take up his option to leave in 2018, but at the same time has declined to serve …

Read More »Standard Chartered profit misses estimates on revenue drop

AFP Standard Chartered Plc reported third-quarter profit that fell short of analyst estimates as revenue declined at all four of its divisions. Adjusted pretax profit was $458 million compared with a loss of $139 million a year earlier, the London-based lender said in a statement on Tuesday. That missed the $520 million average estimate of six analysts surveyed by …

Read More »Barclays’s 25% UK office space cut signals glut threat

Bloomberg Barclays Plc’s decision to cut 25 percent of its London office space highlights the growing risk that tenants will be in short supply for developers of buildings being constructed. The lender is seeking to sublease offices in the Canary Wharf financial district to the UK government, according to two people with knowledge of the matter. They asked not …

Read More »Indonesia Central Bank chief faces graft charges

Bloomberg Indonesia’s central bank Governor Agus Martowardojo was questioned by the nation’s anti-corruption agency as a witness in a probe relating to a government contract that was awarded during his time as finance minister. Martowardojo appeared at the offices of the agency known as KPK on Tuesday, Andiwiana Septonarwanto, deputy director of communications at Bank Indonesia, said in a …

Read More »ANZ to sell Asia wealth and retail units to DBS

Bloomberg Australia & New Zealand Banking Group Ltd.’s sale of businesses in five Asian markets to DBS Group Holdings Ltd. offers the latest sign of consolidation in the region’s highly competitive wealth industry, which has already seen a retreat by European players like Barclays Plc and Societe Generale SA. DBS will pay S$110 million ($79 million) for retail and …

Read More »Saxo Bank top traded CFDs

Dubai/ Emirates Business Saxo Bank, the online multi-asset trading and investment specialist, revealed that the most traded equity CFDs (Contracts for Difference) in the MENA region are focused on the US stock market and US tech companies. Two of the top three most traded CFD equity indexes by Saxo clients in the MENA region since January 1, 2015 are …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.