London / AFP International banks have enquired about switching operations from London to Paris following Britain’s vote in favour of exiting the European Union, according to a senior official at France’s markets regulator. “Large international banks… have already undertaken real due diligences and we have received a lot of practical questions regarding the way they are going to be …

Read More »Banking

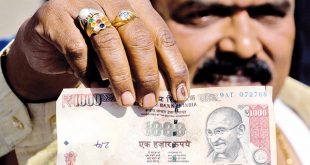

Rupee carry appeal boosted by India rate surprise before Fed

Bloomberg Here’s a silver lining for India’s bond bulls stung by losses after the central bank’s surprise decision not to cut benchmark interest rates — better rupee outlook. Analysts say the Reserve Bank of India panel’s move to hold rates, which caused the benchmark 10-year yield to jump the most since 2013, could revive overseas demand for rupee debt …

Read More »UniCredit lifts capital level with $2.6bn Pekao unit sale

Bloomberg UniCredit SpA advanced its plan to boost capital, agreeing to sell 32.8 percent of Poland’s Bank Pekao SA to Insurer PZU SA and a Polish development fund for 10.6 billion zloty ($2.6 billion). The sale will lift UniCredit’s CET1 capital ratio 55 basis points above its Sept. 30 level, the Italian bank said in a statement on Thursday. …

Read More »BofA ups referral quota for Merrill Lynch wealth advisers

Bloomberg Bank of America Corp. doubled the number of internal referrals that advisers in its Merrill Lynch wealth-management unit must make to avoid having their compensation cut. The brokers must refer at least two clients annually for banking services in other parts of the company starting in 2017, up from one, said Susan McCabe, a spokeswoman for the Charlotte, …

Read More »World’s oldest bank asks ECB for extension

Rome / AFP The world’s oldest bank, Italy’s Monte dei Paschi di Siena (BMPS), asked the European Central Bank for more time to raise the cash it needs to avoid being wound down. BMPS said it was asking for the extension from the end of December to mid January because the political instability created by Prime Minister Matteo Renzi’s …

Read More »PrivateBancorp halts vote on CIBC bid

Bloomberg PrivateBancorp Inc. postponed a shareholder vote on a takeover by Canadian Imperial Bank of Commerce (CIBC) after proxy-advisory firms and some investors called the $3.96 billion cash-and-stock offer insufficient following a post-election rally of U.S. regional lenders. “In view of the significant changes to trading market conditions over the past few weeks, we believe it is in the best …

Read More »Al Baraka eyes $300mn Tier 1 sukuk issue

MANAMA / Reuters Al Baraka Banking Group is targeting the sale of capital-boosting sukuk worth $300 million in the first quarter of 2017, the chief executive of the Bahrain-based Islamic lender, with operations in over a dozen countries, said on Tuesday. “You’ll see issuance of sukuk in the first quarter of 2017 around $300 million, and we are talking …

Read More »HSBC unfazed as best emerging bonds hit by India rate shock

Bloomberg Indian sovereign bonds will recover from their biggest loss in more than three years as benign cash conditions in the banking system spur demand for debt and policy makers return to cutting interest rates in early 2017, according to HSBC Holdings Plc. The benchmark 10-year yield jumped 21 basis points to 6.41% on Wednesday, the biggest increase since …

Read More »ABN Amro to sell Asian private banking business to LGT

Bloomberg ABN Amro Group NV agreed to sell its private-banking assets in Asia and the Middle East to Liechtenstein-based LGT Group, following its European rivals in shrinking overseas operations. The unit manages about $20 billion in Singapore, Hong Kong and Dubai, representing about 10 percent of its private-banking assets globally, the Dutch bank said in a statement on Tuesday. …

Read More »Barclays to save $45mn with office sublet

Bloomberg Barclays Plc agreed to sublet office space in London’s Canary Wharf financial district to the UK government, saving the cost-pressured British bank about 35 million pounds ($45 million) a year. The Cabinet Office will lease about 540,000 square feet of space in 10 South Colonnade, according to a statement on Barclays’s website Tuesday. IT and human resources staff …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.