Bloomberg Royal Bank of Canada is taking care of business at home. Royal Bank, the first Canadian lender to report fiscal third-quarter results, saw a jump in profit from its domestic banking operations amid signs that the nation’s economy is accelerating. An improving outlook prompted Canada’s central bank to raise interest rates last month, and economists predict at least one …

Read More »Banking

Motsepe to shake up South Africa banks with Tyme

Bloomberg African Rainbow Capital Ltd.’s banking partner is close to getting a license that it wants to use to challenge the dominance of South Africa’s biggest lenders. The Commonwealth Bank of Australia has said it will sell 10 percent of Tyme, a Johannesburg-based lender that allows customers to access funds through their mobile phones, to billionaire Patrice Motsepe’s African Rainbow …

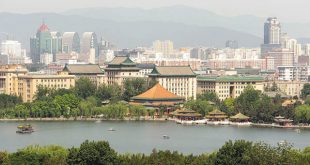

Read More »China’s HNA raises billions from shadow banks that worry Beijing

Bloomberg Few companies have come to symbolise China’s global ambitions quite like HNA Group Co. In just three years, the private conglomerate has invested at least $45 billion around the world. How did HNA pay for it all? That question is gaining new urgency as Beijing moves to curb debt-fueled overseas investments that could ultimately pose risks to the nation’s …

Read More »Nigeria offers liquidity to boost Islamic banking

Reuters Nigeria’s central bank said it is setting up two financial instruments to provide liquidity support to its non-interest paying lenders. It is a push by Nigeria, home to the largest Muslim population in sub-Saharan Africa, to establish itself as the African hub for Islamic finance, which follows religious principles such as bans on interest and gambling. The central bank …

Read More »Guptas dismantle South African empire as bank accounts close

Bloomberg The Gupta family are selling their assets in South Africa to little-known companies as their access to banking facilities dries up and allegations intensify that they used their friendship with President Jacob Zuma to wield undue influence over his administration. On Wednesday they announced the sale of a coal business to a Swiss company that has no history in …

Read More »Bitcoin winner riding crypto wave aims to raise $100mn

Bloomberg Jehan Chu says he’s got an early-mover advantage that will help his cryptocurrency fund stand out from the crowd. The Hong Kong-based former art adviser started investing in bitcoin in 2013, when the digital asset saw its first major rally. Since then, prices have quadrupled, enabling Chu to quit his job, start a venture capital firm investing in blockchain …

Read More »Owners watch Otkritie flail as Russia reboots banks

Bloomberg As Russia’s second-biggest private bank implodes, its billionaire owners have been conspicuous by their absence. By leaving Bank Otkritie FC to fend for itself, the four shareholders controlling more than a third of the company—their combined fortune valued at over $20 billion —may be giving the authorities little choice but to swoop in with a rescue. Now the central …

Read More »US banks could see profit jump 20% with Trump deregulation

Bloomberg The deregulation winds blowing through Washington could add $27 billion of gross profit at the six largest US banks, lifting their annual pretax income by about 20 percent. JPMorgan Chase & Co. and Morgan Stanley would benefit most from changes to post-crisis banking rules proposed by Donald Trump’s administration, with pretax profit jumping 22 percent, according to estimates by …

Read More »Record reserves turn costly cash pile for Indian central bank

Reuters As India’s foreign-exchange reserves march towards the unprecedented $400 billion mark, its central bank faces a costly conundrum. To keep the rupee stable and exports competitive, it is having to mop up inflows that’s adding cash to the local banking system. Problem is, banks are flush with money following Prime Minister Narendra Modi’s demonetisation programme last year, leaving them …

Read More »Central banks must be open-minded to meet challenges, says ECB’s Draghi

Bloomberg Mario Draghi said that while central-bank actions over the last decade have strengthened the global economy, it is important to be open-minded in readying for future developments. In a speech that gave no specific signals on the European Central Bank’s current policy deliberations, the institution’s president stressed that officials must be “unencumbered by the defense of previously held paradigms …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.