Bloomberg The Philippine central bank left its benchmark interest rate at a record low as it forecast inflation will remain inside the target band this year and in 2019. Bangko Sentral ng Pilipinas held the overnight borrowing rate at 3 percent, it said in a statement in Manila, as predicted by 11 of 17 economists surveyed by Bloomberg. The rest …

Read More »Banking

Regional banks see more 2018 Fed rate hikes if outlook holds

Bloomberg Two regional Federal Reserve bank presidents said they favour raising interest rates twice more this year following a hike this week, but were open to shifting their views if the outlook warranted a different policy approach. “My forecast had three moves for this year,’’ Atlanta Fed President Raphael Bostic, who votes this year on monetary policy, told reporters after …

Read More »ECB acts to ensure glitch-free journey to smooth QE end

Bloomberg The European Central Bank is making sure its bond-buying program doesn’t run into any problems in Germany in the final stretch. Six months before purchases are currently set to expire, the ECB added seven German regional development agencies to the list of institutions whose debt is eligible for quantitative easing. The expansion was done at the request of the …

Read More »BofA to pay $42mn in electronic trading probe

Bloomberg Bank of America Corp.’s corporate and investment banking division agreed to pay $42 million to settle a New York state probe into a so-called masking scheme in which it misled clients about who was seeing and filling their orders and who was trading in its dark pool. Bank of America Merrill Lynch for years, starting in 2008, had trading …

Read More »JPMorgan faces backlash over oil sands funding

Bloomberg JPMorgan Chase & Co. considers itself a leader among banks fighting climate change. Chief Executive Officer Jamie Dimon lauded the 2015 global Paris accord, and the bank has committed to buying and financing clean energy, as well as reducing its coal-industry work. Yet the bank is the top US lender and financier to oil-sands producers and pipeline companies, according …

Read More »BOJ gets halfway to inflation target as yen clouds outlook

Bloomberg Japan’s key inflation gauge ticked up in February, putting the Bank of Japan halfway to its goal of 2 percent. Yet a strengthening yen and the threat of a global trade war underscore the central bank’s vulnerability to global markets and events. Despite the progress made, inflation remains far from the BOJ’s target, while the yen’s 7 percent gain …

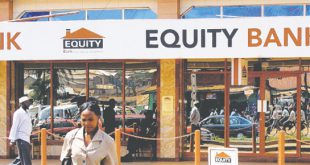

Read More »Kenya top bank vows ‘no trade-offs’ in rate spat

Bloomberg Kenya’s biggest bank by market value is not giving up an inch as lenders go head-to-head with the government over what they can charge customers. The introduction of interest-rate caps in late 2016 has caused lending to grind to a near halt, spurring the International Monetary Fund to warn that growth in East Africa’s largest economy could suffer if …

Read More »BOE piloting anonymous job applications to improve diversity

Bloomberg The Bank of England is piloting anonymous job applications to promote diversity. The more than three-century old central bank only appointed its first female senior official in 1988, according to a speech by Chief Operating Officer Joanna Place at an event in London. It’s one of a handful of new measures to boost the proportion of women at that …

Read More »Asian banks set to hold fire as Fed hikes rates

Bloomberg Most Asian central banks will stand pat for now, even with the Federal Reserve poised to raise borrowing costs this week. While previous tightening cycles in the US prompted many Asian nations to move in lockstep, things are different this time. Subdued inflation and healthy foreign reserves reduce the need to move quickly and the risk of a trade …

Read More »China allows foreign firms to payments market

Bloomberg China will now permit foreign companies to access its $27 trillion payments market, which will further open up the world’s second-largest economy. Foreign players can start applying for payment licenses and will be treated the same as local firms, the People’s Bank of China said in a statement on Wednesday. Applicants must set up local units, establish payment infrastructure …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.