Bloomberg A global squeeze on emerging market assets has forced the Reserve Bank of India to take actions that sometime appear at conflict with each other. To help cool rising bond yields, the central bank said that it will buy bonds for the first time in 18 months, infusing cash into financial markets. But that counters moves to prop up …

Read More »Banking

Philippine central bank pulls rate trigger as economy booms

Bloomberg The Philippines became the latest emerging market to raise interest rates, following through with a pledge to curb inflation in a booming economy. Bangko Sentral ng Pilipinas increased the overnight reverse repurchase rate to 3.25 percent from a record-low 3 percent, it said in a statement in Manila. Thirteen of 16 economists predicted the decision, with the rest expecting …

Read More »Draghi presses for euro-area fund as buffer in future crises

Bloomberg European Central Bank President Mario Draghi stepped up his call for a euro-area fund to make sure countries don’t drift apart in future crises. “We need an additional fiscal instrument to maintain convergence during large shocks, without having to overburden monetary policy,†he said at a European Union event in Florence, Italy. “Its aim would be to provide an …

Read More »Mexico says ‘bank hack’ led to large cash withdrawals

Bloomberg Several Mexican banks experienced large cash withdrawals in recent weeks after possible cyber attackers infiltrated some financial institutions, triggering unauthorised money transfers, the central bank said in an interview with Bloomberg. Banco de Mexico has zeroed in on five financial institutions whose external connection to the central bank’s electronic payment system was compromised, Lorenza Martinez, the central bank’s head …

Read More »Morgan Stanley spars with Deutsche Bank as derivatives trades rebound

Bloomberg A legal battle is heating up over scraps of a synthetic securitisation structured before the global financial crisis, highlighting risks in derivatives trades that are proliferating again. Deutsche Bank AG and Morgan Stanley are fighting over 36 million euros ($43 million) that wasn’t repaid to junior noteholders. The deal matured in December 2016 and was designed to provide credit …

Read More »Wells Fargo growth ban won’t end until vote of Fed board

Bloomberg Unprecedented growth restrictions imposed on Wells Fargo & Co. will stay in place until the Federal Reserve’s board agrees that the bank has made enough progress in fixing flaws that led to customer-abuse scandals over the past two years, Fed Chairman Jerome Powell said in a letter to Senator Elizabeth Warren. In a letter to Warren dated May 10, …

Read More »Bankers with broken English are Luxembourg’s Brexit bottleneck

Bloomberg Luxembourg’s citizens can quickly impress with their language skills, switching with ease between their local tongue and German, French and English. But insurers, investment firms and banks hoping to open post-Brexit outposts in one of the European Union’s most important financial hubs may be in for a surprise. Head hunters say there simply aren’t enough candidates in and around …

Read More »BOE seen losing time to create breathing room before Brexit

Bloomberg Mark Carney’s window to raise interest rates before Brexit is closing. As Britain draws nearer to its divorce from the European Union at the end of March with little certainty as to the economic repercussions, Bank of England policy makers with a benchmark interest rate of just 0.5 percent could be left with limited room to cut should they …

Read More »Wells Fargo owes California bankers $97mn for breaks

Bloomberg Wells Fargo & Co. must pay $97 million to home mortgage consultants and private mortgage bankers in California who didn’t get the breaks they were entitled to under the state’s stringent labor laws. A federal judge in Los Angeles agreed with the bankers and consultants that the money they were entitled to should be based not just on their …

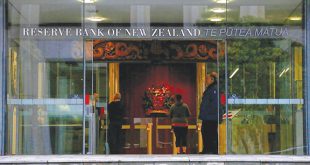

Read More »RBNZ keeps rate at record low, leaves door open to cut

Bloomberg New Zealand’s central bank held interest rates at a record low and left the door open to a cut as inflation remains subdued. Reserve Bank Governor Adrian Orr kept the official cash rate at 1.75 percent and said it would remain there “for some time to come.†The RBNZ pushed out its forecast for the first OCR increase to …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.