Bloomberg Indonesia’s central bank should signal interest-rate cuts to draw more foreign money into the nation’s bonds, according to a top emerging markets asset manager. The current-account deficit will remain manageable and Bank Indonesia has room to reverse some of the rate hikes it implemented last year, Anil Kumar, who helps manage about $76 billion of funds at Ashmore Plc, …

Read More »Banking

Japanese M&A spree a boon for foreign banks

Bloomberg Japan Inc.’s record acquisition spree is proving to be better news for overseas investment banks than for their home-grown rivals. Foreign firms led by Goldman Sachs Group Inc. grabbed the first three places in Japan’s merger advisory rankings last year, handling deals worth a combined 44.6 trillion yen ($403 billion), according to data compiled by Bloomberg. Nomura Holdings Inc, …

Read More »Modi gets $4bn cash from India’s RBI before polls

Bloomberg India’s central bank approved an early transfer of a part of its profit to the government, which is desperate for cash to fund populist pledges ahead of a national election. The Reserve Bank of India’s board, approved 280 billion rupees ($4 billion) as interim dividend, according to a statement. This is the second straight year that the RBI has …

Read More »Yes Bank falls as India central bank censures selective disclosure

Bloomberg Yes Bank Ltd. fell after India’s central bank reprimanded it for selectively revealing a “confidential†report by the regulator that led to a 30 percent surge in the lender’s shares. The regulator called the disclosure a “deliberate attempt†to mislead the public. The risk assessment report on Yes Bank prepared by the Reserve Bank of India identified several lapses …

Read More »Deutsche Bank investor sold stock at double market price

Bloomberg When HNA Group Co. became Deutsche Bank AG’s top shareholder in early 2017, the German lender’s shares were trading near two-year highs and the fledgling Chinese airline was voicing ambitions of turning into a big player on Wall Street. Then both firms ran into roadblocks. HNA has since lost its seemingly insatiable appetite for growth, embarking on a selling …

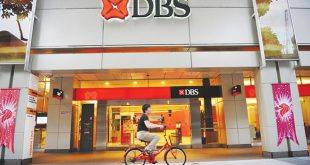

Read More »DBS’s wealthy clients resume trading

Bloomberg DBS Group Holdings Ltd.’s chief executive said rich clients are getting more active in trading again, recovering from fourth-quarter turmoil that caused a slump at its wealth management unit. “People just froze†because of the equity market sell-off late last year, Piyush Gupta said in an interview with Bloomberg Television on Monday, soon after his bank reported a 10 …

Read More »ECB could change rates guidance, says Villeroy

Bloomberg The slowdown of the European economy is “significant†and the European Central Bank could change its interest-rates guidance if it becomes clear the situation isn’t temporary, Governing Council member Francois Villeroy de Galhau said. The extent of the weakness at the end of 2018 has taken policy makers by surprise, with Italy entering recession and Germany narrowly avoiding the …

Read More »Deutsche Bank reverses pledge to help distressed homeowners

Bloomberg Deutsche Bank AG has decided that none of the more than $4 billion it promised to spend on consumer relief after the global mortgage crisis will go to distressed US homeowners, according to a report by the monitor of the 2017 settlement. Instead, the consumer-relief money will be spent on originating new loans, according to the February 13 report …

Read More »StanChart, BNP among banks to be added to Aramco bond

Bloomberg Standard Chartered Plc and BNP Paribas SA are among about a dozen banks likely to be added as co-managers for Saudi Aramco’s landmark international bond sale, people with knowledge of the matter said. Two Japanese lenders — Mitsubishi UFJ Financial Group Inc., Mizuho Financial Group Inc. — as well as Samba Financial Group and Gulf International Bank BSC are …

Read More »Italian state bank mulls doubling Telecom Italia stake

Bloomberg The Italian state lender that’s backing Elliott Management Corp. in a battle for the future of Telecom Italia SpA is considering doubling its stake in the former phone monopoly, people familiar with the matter said. Cassa Depositi e Prestiti SpA was authorized by its board to buy as much as 10 percent of Telecom Italia’s stock if a management …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.