Bloomberg In a world of persistently low inflation and slowing economic growth, central banks are finding a useful instrument in their toolboxes to curb financial risk. Macroprudential measures — such as limiting who gets a mortgage and adjusting banks’ reserve requirements — have gained traction with central banks since the global financial crisis, and are proving effective. The targeted tools …

Read More »Banking

Moore calls for 50-point Fed interest rates cut

Bloomberg Stephen Moore, who Donald Trump may nominate for a seat on the Federal Reserve Board, told the New York Times in an interview that the central bank should immediately reverse course and lower interest rates by half a percentage point. That’s a contrast from language used by sitting board members in recent days. San Francisco President Mary Daly told …

Read More »â€˜ECB may need to soften impact of negative rates’

Bloomberg Mario Draghi said the European Central Bank (ECB) is ready to soften the impact of negative interest rates if they are found to harm the transmission of its monetary policy. “If necessary, we need to reflect on possible measures that can preserve the favorable implications of negative rates for the economy, while mitigating the side effects, if any,†the …

Read More »PBOC may turn less dovish in 2019

Bloomberg The People’s Bank of China (PBOC) is expected to ease policy less aggressively in 2019 compared with the previous year, while maintaining steady injections of liquidity, according to analysts. The PBOC will continue to reduce the amount of money lenders have to put aside as reserves, with the earliest cut taking place next quarter and two others in the …

Read More »New Zealand joins global shift away from high rates

Bloomberg New Zealand’s central bank joined the global shift away from higher interest rates, saying its next move is more likely to be a cut and sending the kiwi dollar tumbling by the most in seven weeks. “Given the weaker global economic outlook and reduced momentum in domestic spe-nding, the more likely direction of our next OCR move is down,†…

Read More »Hong Kong grants licenses to virtual banks

Bloomberg Hong Kong’s traditional banks are set to face one of their biggest challenges yet: a new breed of financial technology firms estimated to snare as much as 30 percent of their revenue. The Hong Kong Monetary Authority has granted three virtual bank licenses and is processing five more, Deputy Chief Executive Arthur Yuen said in a briefing on Wednesday. …

Read More »Malaysia central bank vows support as GDP forecast cut

Bloomberg Malaysia lowered its economic growth forecast for 2019, and pledged to keep policy accommodative as global risks weigh on the trade-reliant economy. Gross domestic product is expected to increase 4.3 percent to 4.8 percent in 2019, with trade tensions and lower commodity prices among the biggest wildcards, Bank Negara Malaysia said in its annual report on Wednesday. The projection …

Read More »Deutsche Bank hires SCB’s Suntichok as Thailand head

Bloomberg Deutsche Bank AG has hired Siam Commercial Bank (SCB) Pcl’s Pimolpa Suntichok to head its business in Thailand, according to people with knowledge of the matter. She will join the German lender in May as chief country officer and head of the financing and solutions group for Thailand, one of the people said, asking not to be identified because …

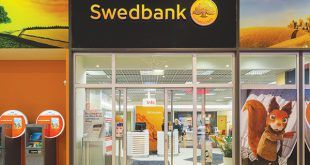

Read More »Swedish money laundering case spins widening web of intrigue

Bloomberg As Sweden gets to grips with the money laundering scandal battering its oldest bank, questions are being asked about the impartiality of those overseeing the case. Swedbank AB reportedly handled more than $10 billion in suspicious flows tied to the Danske Bank A/S Estonian laundering scandal. The case became public knowledge only this year, but according to Swedish media …

Read More »Euro-area banks set to know ECB loan details by June

Bloomberg Euro-area banks will know by June how generous the terms of the European Central Bank’s new loans are going to be, according to Governing Council member Olli Rehn. Policy makers have yet to pass judgment on the severity of the current slowdown that prompted that measure, the Finnish central bank governor told Bloomberg in an interview. They are determined …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.