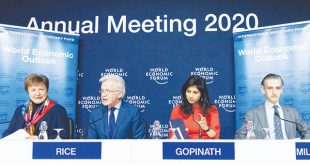

Bloomberg The International Monetary Fund (IMF) predicted the world economy will strengthen in 2020, albeit at a slightly slower pace than previously anticipated amid threats related to trade and tensions in the Middle East. Global growth will accelerate to 3.3% from 2.9% in 2019, marking the first pickup in three years, the fund said. Both figures are down compared with …

Read More »Banking

BOJ leaves rates unchanged, raises growth forecasts

Bloomberg The Bank of Japan (BOJ) took a brighter view of the economy and left its main policy settings unchanged on Tuesday, offering a further indication that it is unlikely to add to its stimulus. As had been widely expected, the BOJ raised its growth projections for the first time in a year, thanks to Prime Minister Shinzo Abe’s $120 …

Read More »Pound gains as jobs data hits BOE ‘rate cut’

Bloomberg The pound advanced after the UK’s employment rate hit a record high, weakening the case for an imminent interest-rate cut. Sterling rose against all its Group-of-10 peers as the UK labour market figures ended a run of weak economic data. Money markets trimmed bets that the Bank of England (BOE) will lower borrowing costs on January 30 to around …

Read More »â€˜Palladium may surge to test $3,000, then slide’

Bloomberg Palladium’s extraordinary rally has the potential for prices to go on and test $3,000 an ounce, according to Goldman Sachs Group Inc’s Jeffrey Currie, who twinned that outlook with a clear warning that such peaks wouldn’t last for long as the record levels would cut into demand. “The upside potential is significant as the market is now in a …

Read More »UBS misses key targets in challenge to Iqbal Khan overhaul

Bloomberg UBS Group AG missed key targets for 2019 as investors pulled money late in the year, underscoring the challenge for new wealth management co-head Iqbal Khan as he seeks to turn around its most important business. The Swiss bank failed to meet several metrics set during a revamp of its goals just over a year ago, highlighting mounting headwinds …

Read More »Many branch jobs are still safe from machines: Citi CEO

Bloomberg Citigroup Inc spends about $8.5 billion a year on technology, but the bank’s boss says that doesn’t mean branch workers will all be replaced by machines anytime soon. Modernising the bank’s app and digital-banking experience won’t necessarily result in Citigroup needing fewer people in its retail bank, Chief Executive Officer Michael Corbat said on Tuesday in a Bloomberg Television …

Read More »India bond yields are headed higher amid inflation worries

Bloomberg Even as the Reserve Bank of India (RBI) takes a page out of the Federal Reserve’s playbook to push down borrowing costs, yields are headed higher as inflation is unlikely to abate soon, according to Aditya Birla Sun Life AMC Ltd. Inflation will probably remain elevated over the next six to 12 months, according to Maneesh Dangi, who oversees …

Read More »Deutsche Bank bids for another ailing India power project’s debt

Bloomberg Deutsche Bank AG is offering to buy the debt of an Indian power producer at a discount of about 70%, according to people familiar with the matter, the second such proposal from the German lender in recent weeks. It proposed to pay 11.50 billion rupees ($162 million) for 39 billion rupees of loans, excluding accrued interest, to a power …

Read More »Citi Private Bank hires UBS veteran Christian Schuwey for Asia FX role

Bloomberg Citi Private Bank appointed Christian Schuwey, formerly from UBS Private Bank, as its head of South Asia FX Advisory, according to a company memo seen by Bloomberg. Schuwey, who worked at UBS for more than 30 years in foreign-exchange roles, is based in Singapore, according to the memo. He will drive Citi’s efforts to grow in Southeast Asia, India, …

Read More »JPMorgan to acquire former BNP building in central Paris

Bloomberg JPMorgan Chase & Co is buying the former BNP Paribas SA offices in central Paris with space to house as many as 450 employees, as banks seek to bolster their footprint in the European Union after Brexit. JPMorgan, which currently has 260 employees in the French capital, is taking over the seven-storey building a short walk from the Louvre …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.