Bloomberg Nomura Holdings Inc is hiring bankers for its mergers and acquisitions business in Japan as a sharp rebound in domestic deal-making vaults the nation’s biggest securities firm to the top ranks of global advisers. “We’re recruiting people more eagerly than usual,†global M&A head Shunichi Tsunoda said in an interview. Consultations on local deals are up about 30% to …

Read More »Banking

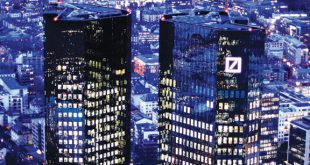

Deutsche may sell tech unit to Tata Consultancy

Bloomberg Deutsche Bank AG is in advanced talks to sell a technology services unit to Tata Consultancy Services Ltd, Asia’s biggest software exporter by market value, people with knowledge of the matter said. The discussions about Bonn-based Postbank Systems AG are expected to result in a deal with the Indian company by the end of the year, the people said, …

Read More »Asia’s richest banker explores takeover of IndusInd

Bloomberg Kotak Mahindra Bank, backed by Asia’s richest banker, is exploring a takeover of smaller Indian rival IndusInd Bank, people with knowledge of the matter said, a move that would create the nation’s eighth-largest financial firm by assets. Uday Kotak, founder and chief executive officer of Kotak Mahindra, is looking at the possibility of an all-stock acquisition, one of the …

Read More »UBS to boost fixed salaries, cut bonuses

Bloomberg UBS Group AG plans to raise the fixed salaries for some of its more senior employees by as much as 20% to prevent poaching by competitors. A review at Switzerland’s largest bank found differences in base pay among employees in the same roles, and when compared with competitors, people familiar with the plans said. As a result, UBS plans …

Read More »SNB may have to sell some of its $100bn in US stocks

Bloomberg The Swiss National Bank (SNB) could be forced to sell a chunk of its more than $100 billion US stock portfolio as part of a campaign to ban it from investing in defense companies. A poll by gfs.bern for public broadcaster SRG showed 54% of voters in favour of the proposal, which goes to a national vote on November …

Read More »Wells Fargo weighs asset-manager sale

Bloomberg Wells Fargo & Co. is exploring the sale of its asset-management unit as the biggest banks choose paths of diving deeper into the business or getting out. The Wells Fargo unit could fetch more than $3 billion, according to a person briefed on the matter, who said the bank began discussing a possible deal with other asset managers and …

Read More »Barclays climbs as Staley’s traders thrive on volatility

Bloomberg Barclays Plc Chief Executive Officer (CEO) Jes Staley’s drive to make investment banking the centerpiece of his strategy paid off in the third quarter, with equities trading in a volatile market beating the bank’s Wall Street peers. The shares approached a two-month high. The London-based bank’s equity trading income jumped 40% and foreign-exchange, rates and credit trading rises 23%, …

Read More »Riksbank revealing grim view of latest Covid trend

Bloomberg The Riksbank governor, Stefan Ingves, fears the economic outlook is deteriorating amid signs the coronavirus pandemic is tightening its grip across Europe, and ensnaring Sweden again too. “If you look at our forecasts, it will take a few years before GDP is back†at pre-crisis levels, Ingves said in an interview in Stockholm. “And those forecasts were done before …

Read More »Spare cash spurs record demand for debt in Europe

Bloomberg There’s so much cash in Europe there are just not enough bonds to go around. The amount of spare liquidity in the euro-area economy hit an all-time high of 3.2 trillion euros ($3.8 trillion) this month and plenty of that is chasing any new debt issue. This was seen in the record 233 billion euros of orders for the …

Read More »MUFG rules out more cuts at Asia brokerage

Bloomberg Mitsubishi UFJ Financial Group Inc. is ruling out further job cuts at its brokerage business in Asia after a lengthy overhaul, even as global banks trim headcount during the pandemic. “We are done with it — it’s over,†Saburo Araki, chief executive officer of Mitsubishi UFJ Securities Holdings Co., said in an interview. “It must have been painful for …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.