Bloomberg Sweden’s central bank raised its interest rate and signalled more increases to come, completing a U-turn in monetary policy to join global peers in the fight against inflation. The krona jumped as the Riksbank raised its policy rate to 0.25% from zero, and said it will enact another two or three hikes in 2022. Officials also pledged to …

Read More »Banking

UBS becomes third global bank to lose China boss this month

Bloomberg UBS Group AG’s David Chin is stepping down as China country head, the third senior executive at a global lender in the nation to exit this month as bankers are hobbled by a strict Covid Zero strategy and a crackdown on private enterprise. After two years in the role, Chin will be succeeded by Eugene Qian, chairman of …

Read More »HSBC warns of China headwinds, more real estate loan losses

Bloomberg HSBC Holdings Plc, the largest foreign bank in China, warned of further potential hits from the nation’s battered real estate market as defaults continue to climb amid a worsening Covid-19 outbreak. “It’s a big call to say that we’ve seen the worst,†Ewen Stevenson, HSBC’s chief financial officer, said in an interview with Bloomberg News. “Do I think …

Read More »Santander delivers earnings beat fired by rates, currencies

Bloomberg Banco Santander SA’s earnings beat estimates, with the retail banking giant’s geographical reach providing a buffer against growing economic risks in Europe from the war in Ukraine. Spain’s biggest lender posted net income of 2.54 billion euros ($2.72 billion) in the first quarter, exceeding the analyst consensus of 2.26 billion euros, as rising lending revenue offset increased costs …

Read More »Nomura posts $242m net profit in Q1 2022

Bloomberg Nomura Holdings Inc posted a fourth straight quarter of profit as Japan’s largest brokerage booked gains from a stake sale in one of its affiliated companies, offsetting further provisions for a legal case in the US. Net income totalled 31 billion yen ($242 million) in the three months ended March 31, the firm said in a statement. Nomura …

Read More »JPMorgan’s Southeast Asia ECM head quits

Bloomberg Novan Amirudin, head of Southeast Asia equity capital markets at JPMorgan Chase & Co., is leaving after serving more than 15 years at the US bank, according to people familiar with the matter. Novan, who is also head of Malaysia investment banking at JPMorgan, tendered his resignation this week, said the people. He has started his gardening leave, …

Read More »Deutsche Bank’s traders take Sewing closer to profit goal

Bloomberg Deutsche Bank AG raised the outlook for its investment bank after fixed-income traders outperformed Wall Street peers for a seventh straight quarter, boosting Chief Executive Officer Christian Sewing in the final year of his turnaround plan. Revenue from buying and selling fixed-income securities rise 15% from a year earlier, beating the biggest US investment banks, where the business …

Read More »Credit Suisse sheds more executives after another quarterly loss

Bloomberg Credit Suisse Group reported a bigger-than-expected loss, parted ways with three senior executives and warned that the full damage from one of the most turbulent periods in its history is yet to be accounted for. The Zurich-based bank posted a net loss of 273 million Swiss francs ($284 million), in the first quarter driven by 703 million francs in …

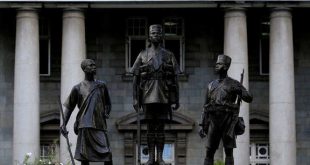

Read More »StanChart raises revenue outlook

Bloomberg Standard Chartered (StanChart) Plc shares surged after it beat estimates in the first quarter and the lender said revenue would climb more this year than the previously predicted. Underlying pretax profit posted a surprise 4% rise to $1.5 billion in the period on a jump from its trading business, the London-based bank said in a statement on Thursday. Revenue …

Read More »China’s central bank seeks to calm markets with support pledge

Bloomberg China’s central bank pledged to support the economy through targeted financing for small businesses and a quick resolution of the ongoing crackdown on technology firms in Beijing’s latest bid to reassure investors nervous about growth and Covid lockdowns. The People’s Bank of China (PBOC) “will step up the prudent monetary policy’s support to the real economy, especially for …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.