KUALA LUMPUR / WAM The 4.2 per cent annual Gross Domestic Product (GDP) growth recorded for the first quarter (1Q16) as announced by Bank Negara Malaysia exceeded the forecast of economists. It came in higher than the consensus estimate of 4.0 per cent, said Bank Islam Malaysia Bhd Chief Economist Dr Mohammed Afzanizam Abdul Rashid. He commented that the …

Read More »Admin

UCO Bank reports Rs17.2 billion loss, courtesy bad loans

Kolkata / Bloomberg UCO Bank, an Indian state-owned lender with 629 deliberate defaulters, reported the highest bad loan ratio among banks in the South Asian nation. Shares fell the most in three months. Provisions for soured debt at the Kolkata-based company more than doubled to about 23 billion rupees ($344 million) in the three months through March from a …

Read More »Hezbollah vows to support Assad as military chief killed

Beirut /Â AFP Lebanese Shiite militant group Hezbollah on Saturday blamed extremists for killing its top military commander in Syria and vowed to keep fighting to defend President Bashar Al Assad’s regime. The movement has deployed thousands of fighters in Syria where Mustafa Badreddine had led its intervention in support of Assad’s forces, which are also backed by Russia and …

Read More »Indian court: Former UN climate head to stand trial

NEW DELHI /Â AP A court in India’s capital ruled Saturday that there’s enough evidence in a stalking and sexual harassment case for former UN climate chief Rajendra Pachauri to stand trial. Judge Shivani Chauhan announced that the next hearing in the case will be on July 11, the Press Trust of India news agency reported. Police filed charges against …

Read More »2 Indian journalists killed

New Delhi / AFP Gunmen shot dead two journalists in 24 hours in separate incidents in eastern India, police and local reports said on Saturday, the latest media killing in Asia’s deadliest country for reporters. Rajdeo Ranjan, the local bureau chief for Hindi-language daily Hindustan, was travelling on his motorcycle late Friday in Bihar state when a group of …

Read More »Nigeria hosts global summit on Boko Haram

Abuja / AFP Nigeria on Saturday hosted talks on Boko Haram with regional and Western powers, as the United Nations warned of the militants’ ties to the IS group and its threat to African security. Leaders from Benin, Cameroon, Chad and Niger were among the delegates, alongside French President Francois Hollande, and high-ranking diplomats from the United States, Britain …

Read More »Migrants rescued off Sicily are not Syrians, says UN

Rome / AFP There were hardly any Syrian migrants among the 800 people rescued off Sicily, contrary to earlier reports from Italy’s coastguard, the UN and the International Organization for Migration have confirmed. The coastguard had said that half of the 342 migrants they had picked up were Syrians, sparking concern that the flow of Syrians previously attempting to …

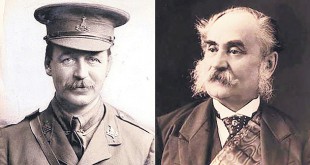

Read More »Sykes-Picot: The secret deal that changed the Mideast forever

Paris/ AFP On May 16, 1916, a secret pact carved up the floundering Ottoman Empire into spheres of British and French interest, foreshadowing the future map of the Middle East and, say critics, sowing the seeds of many of its problems. The Sykes-Picot agreement between the British and French governments for partitioning the empire’s Arab provinces was struck at …

Read More »Brazil’s interim president vows to get country ‘back on track’

Brazil /Â AFP Brazil’s acting president Michel Temer vowed to get Latin America’s largest economy back on track after a cascade of crises put an end to 13 years of leftist rule. Temer presided over the first meeting of his new business-friendly cabinet, setting out its priorities: creating a leaner government, balancing finances to address a crippling recession, and rooting …

Read More »N Korea detains Russian yacht

Moscow / AFP A Russian yacht has been detained by North Korean coastguards in the Sea of Japan with five crew on board and towed in to land, Russian officials said on Saturday. “The North Korean side has communicated that the yacht has been taken to the port of Kimchaek,” Igor Agafonov, a foreign ministry official in the far-eastern …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.