Tribune News Service Bahrain is going to be the hub of a new $200 million textile business spread across the Middle East and North Africa (Mena) region. MRS Fashions, which has been putting Bahrain on the global fashion map for the past 16 years through its manufacturing unit in the kingdom, is now setting up its new regional head …

Read More »Admin

B’desh embassy plea on Manama hiring rules

Manama / Tribune News Service A foreign embassy has appealed to Bahraini authorities to relax recruitment procedures for its citizens, which it claimed led to exploitation and were so time-consuming that diplomats had no time for anything else. It has emerged that unscrupulous agents are conning Bangladeshi labourers out of almost a month’s salary to complete the procedures, which …

Read More »Egypt to end local wheat buying on Wednesday

CAIRO / Reuters Egypt will end local wheat buying on Wednesday, earlier than usual, due to exceeding its target of 4 million tonnes, the supplies ministry said on Saturday. “Supplies Minister Khaled Hanafi pointed out that the door for receiving local wheat from farmers will close at the end of Wednesday due to lowering local procurement rates,” the ministry …

Read More »Brexit outcome too close to call with undecideds seen as key

Bloomberg British public opinion is too close to call on whether the country should stay in the European Union, with many voters still undecided as interest groups and political leaders make their cases, according to two polls released this weekend. An online survey by Opinium for the Observer newspaper showed 44 percent support Britain remaining in the 28-nation …

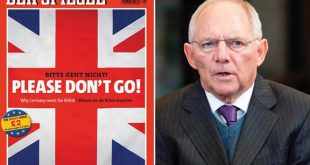

Read More »â€˜Please don’t go,’ Germany’s leading magazine urges Britons

Bloomberg Germany’s biggest news magazine Der Spiegel threw its hat into the Brexit ring with a special edition, thicker and cheaper than usual, adorned with an image of the Union Jack and the German plea “Bitte geht nicht!†or “Please don’t go!†The issue that hit newsstands on Saturday costs 2 pounds, rather than the usual 5.20, in Britain …

Read More »Greek TV stations face sign-off in licensing row

AFP Greece is in the grip of a row over television, with the government under attack for plans to slash the number of private channels in a sector that was hit hard by the financial crisis. Authorities say they want to clean up an industry known for its workforce exploitation and rumoured under-the-table deals between media moguls, bankers and …

Read More »Don’t be caught off guard in ‘Bremain’ relief rally: Nordea

Bloomberg With some polls showing Britain might vote to leave the EU in less than two weeks, investors are increasingly being told to adjust their portfolios to gird for a so-called Brexit. But Nordea, Scandinavia’s biggest bank, says it might also be wise to prepare for the relief rally that would follow the June 23 referendum should Britons choose …

Read More »Auto giants see road to riches by investing in sharing services

Bloomberg Auto giants are racing to invest in car- and ride-sharing services, lured by the prospect of fat profits yet to be tapped from a billion cars on the world’s roads. A typical car spends 95 percent of its life at a standstill, industry analysts say, making it a vastly under-utilised, depreciating asset. There may be big money waiting, …

Read More »British realtors join ‘Remain’ camp as Brexit tensions rise

Bloomberg Britain’s biggest property firms including Barratt Developments Plc and Canary Wharf Group Plc are the latest to take a stand on U.K. membership in the European Union less than two weeks before a vote, saying a decision to leave would hinder development projects and raise the cost to build new homes. In an open letter released on Saturday, …

Read More »UK house prices drop for 1st time since 2012

Bloomberg U.K. house prices look set to dip for the first time since 2012 amid uncertainty before Britain’s vote on European Union membership and as a new tax on buy-to-let properties and second homes kicks in. Home prices in central London are already falling, according to May data from the Royal Institution of Chartered Surveyors. While they continue to …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.