James Mattis, President-elect Donald Trump’s nominee for defense secretary, has called Russia the “most dangerous” short-term threat to US interests and raised the question of whether President Vladimir Putin is “delusional.” Trump, meanwhile, has praised Putin’s savvy and talked of repairing US-Russia relations. This isn’t the only issue on which Mattis is at odds with his prospective boss, and …

Read More »Admin

Trump’s criticism of civil rights icon Lewis backfires

Donald Trump did it again. He called John Lewis, civil rights icon and Democratic congressman ‘all talk and no action.’ The Republican billionaire response came a day after John Lewis described Trump as an illegitimate president. Lewis, like many other Democratic lawmakers, vowed to give Trump’s swearing-in a miss. Trump blasted Lewis saying that he should instead clean his …

Read More »Abu Dhabi Ports, EBG to set up AED80mn warehouse in Kizad

Abu Dhabi / WAM Abu Dhabi Ports signed a Musataha Agreement with Khalidia International Shipping, a subsidiary of Emirates Business Group (EBG) to set up a third-party logistics (3PL) warehouse with a total investment of AED80 million in KIZAD, the Khalifa Industrial Zone’s trade and logistics cluster. The agreement was signed by Mohamed Abdul Jaleel Al Blooki, Chairman of the …

Read More »52 million travellers crossed through Dubai ports during 2016

Dubai /Â WAM The number of passengers through the Dubai air, land and sea ports over the past year had reached about 52 million passengers, according to the statistical report issued by the General Directorate of Residency and Foreigners Affairs-Dubai (GDRFA). Major General Mohammed Ahmed Al Marri, Director -General of the GDRFA said that the passenger traffic through Dubai International …

Read More »Pope Francis praises UAE’s policy of tolerance

Vatican City /Â WAM Pope Francis praised the policy of tolerance pursued by the wise leadership of the UAE in promoting the values of tolerance, compassion and cooperation. The statement was issued during the official visit of Dr. Hessa Abdullah Al Otaiba, UAE Ambassador to Spain, at the invitation of His Holiness Pope Francis for the annual meeting of the …

Read More »DED-Kinokuniya pact to promote culture of reading

Dubai /Â WAM The Department of Economic Development (DED) in Dubai and world-leading bookstore Kinokuniya have signed a memorandum of understanding (MoU) to jointly promote a culture of reading and create spaces for knowledge and innovation. Under the MoU, Kinokuniya will provide books on diverse topics to be displayed in the public library and the Smart Lounge of DED where …

Read More »DM seizes consumer materials hidden in 10 manholes at labour camp

Dubai /Â WAM Inspectors from the Environmental Emergency Office at Dubai Municipality have discovered 10 abandoned manholes, which were being used as storage for consumer items in labour accommodation in Muhaisina, Dubai. Workers had exploited the unnoticed manholes in one of the demolished labour accommodations to store kitchenware, blankets, tools and carpets, as well as different home appliances and accessories. …

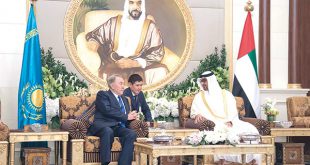

Read More »Mohamed, Kazakh president discuss ways to boost relations

Abu Dhabi /Â WAM His Highness Sheikh Mohamed bin Zayed Al Nahyan, Crown Prince of Abu Dhabi and Deputy Supreme Commander of the UAE Armed Forces, welcomed on Sunday Nursultan Nazarbayev, President of the Republic of Kazakhstan, at Al Mushrif Palace in Abu Dhabi. Nazarbayev is currently on an official visit to the UAE. His Highness Sheikh Mohamed bin Zayed …

Read More »Montenegro president visits Sheikh Zayed Grand Mosque

Abu Dhabi /Â WAM As part of his tour of the UAE, Filip Vujanovic, President of the Republic of Montenegro and his accompanying delegation, visited the Sheikh Zayed Grand Mosque in Abu Dhabi. He paid his respects at the tomb of the late Sheikh Zayed bin Sultan Al Nahyan, where he acknowledged his legacy and wise approach that had contributed …

Read More »WWF, EWS to push ‘renewable energy vision’ at WFES

Abu Dhabi / WAM The Emirates Wildlife Society in association with (WWF, EWS-WWF) announced that it is looking to expand collaboration and push forward its 100% Renewable Energy Vision for the UAE – 2050 project, via its participation at the tenth annual World Future Energy Summit (WFES) in Abu Dhabi this week. Designed as a comprehensive study, the project will …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.