z Bloomberg Discount clothing chain Primark is betting that opening more and bigger stores will drive sales gains, bucking a trend in which competitors are scaling back their bricks-and-mortar presence. The apparel brand, owned by Associated British Foods Plc (AB Foods), expects new stores in the US and Europe to propel sales for the full year. The strategy runs counter …

Read More »Admin

UAE, Saudi urge Yemen government and separatists to halt fighting

Abu Dhabi / WAM The governments of the United Arab Emirates and the Kingdom of Saudi Arabia have welcomed the response by the Legitimate Government of Yemen and the Southern Transitional Council, on the Kingdom’s call for dialogue, saying it is “a major and positive step” towards ending the recent crisis in the governorates of Aden, Abyan and Shabwa. The …

Read More »Saudi King appoints new energy minister

Bloomberg Saudi Arabia’s King Salman dismissed Energy Minister Khalid Al-Falih and replaced him with one of his sons, putting a royal family member in charge of oil policy in the world’s largest crude exporter for the first time. Prince Abdulaziz bin Salman, a longtime top Energy Ministry official, is an older half-brother to the Crown Prince Mohammed bin Salman. Analysts …

Read More »Saudi’s Neom awards contracts for new village to national firms

Bloomberg Saudi Arabia has awarded to two Saudi firms contracts to build worker housing for its futuristic mega-city called Neom, as plans for the $500 billion project move forward. Tamimi Group and Saudi Arabian Trading & Construction Co. won contracts to finance, build and operate three residential areas with capacity to house 30,000 people, Neom said in a statement on …

Read More »China mulls goal of 60% of auto sales to be electric by 2035

Bloomberg China is exploring ambitious new plans for the future of its car industry, weighing a target for 60% of all automobiles sold in the country to run on electric motors by 2035, according to people familiar with the matter. China’s Ministry of Industry and Information Technology is spearheading the government’s latest auto industry plans for 2021 through 2035, said …

Read More »Kenya wins delay in feud with Somalia over oil-rich region

Bloomberg The United Nations International Court of Justice granted Kenya’s request to postpone a hearing of a territorial dispute with Somalia, less than a week before it was scheduled to begin. The hearing will now start on November 4. Kenya had requested that it be delayed for a year as it recruits a new defense team. The neighbours claim ownership …

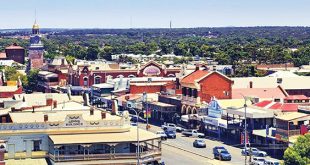

Read More »Australia mining towns leading gains in housing market recovery

Bloomberg Home prices in Australia’s mining towns are leading the recovery in the property market, accounting for nine out of the 10 suburbs with the strongest growth in median prices. The gains were led by a suburb close to the home to one of the world’s largest lead smelters, as well as a once-struggling steel city, as record-low interest rates …

Read More »Stock traders stare into ‘abyss’ a year after Armageddon

Bloomberg Nobody knew it then, but this time last year, the rallying US stock market was about to begin a plunge that would erase $5 trillion from share values and convince a lot of people a recession was at hand. Then, as now, a trade war was raging, earnings in doubt and manufacturing losing steam. In the stock market, swings …

Read More »JPMorgan fears new breed of crypto like Libra face ‘gridlock’

Bloomberg Stablecoins, a fast-growing subset of cryptocurrencies designed to avoid the large fluctuations of Bitcoin and Ether, could fail to function properly in periods of stress, according to JPMorgan Chase & Co. While the total value of all stablecoins is less than $5 billion, the low-volatility tokens are poised for rapid growth, and none more so than the Libra coin …

Read More »Europe-US regulatory split may prolong Max grounding

Bloomberg Aviation executives are increasingly worried that a widening split between regulators in the US and Europe will extend the grounding of Boeing Co’s 737 Max, sowing confusion and fear as officials work to approve the resumption of commercial flights after two deadly crashes. Sounding the alarm over the increasingly tenuous alliance were Aengus Kelly, who heads the largest global …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.