BLOOMBERG

China’s stock market suffers from a lack of positive drivers as the new year begins, and Beijing’s support efforts are likely to keep falling flat amid persistent risks. Those are the key takeaways from an informal survey of 23 mostly mainland-based analysts and money managers by Bloomberg News. Geopolitical tensions, China deflation and a possible US recession are seen as the greatest threats, while potential positives include bargain hunting after the prolonged selloff and an end to the foreign-investor exodus. The benchmark CSI 300 Index is trading near a five-year low as concerns about the Chinese economy fail to dissipate. Monetary policy easing, cash injections and government buying of stocks have done little to fuel a rebound as investors eye a host of problems including an aging population and worries that the property market no longer offers growth.

“Measures to boost stocks are aimed at curing the symptoms not the disease — we hope that authorities may find the resolve to tackle underlying issues in the economy,” said Yu Yingbo, investment director at Shenzhen Qianhai United Fortune Fund Management Co. He added, however, that opportunities outweigh risks at current market levels.

One potential tailwind cited by most of the survey respondents is a likely end to foreign avoidance of Chinese equities. After 2023 witnessed the smallest inflow since the stock connect program with Hong Kong started in 2016, lower global interest rates and improving risk-reward are seen luring foreign investors back to A-shares.

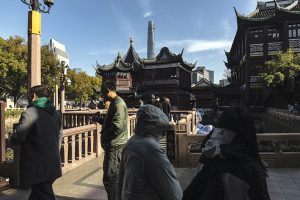

“I don’t think there’s any offshore money to be sold anymore, nearly everything has been sold,” said Hayden Briscoe, APAC head of multi-asset portfolio management at UBS Asset Management, on the sidelines of the bank’s Greater China Conference in Shanghai.

The CSI 300 may end the first quarter at 3,500 points according to the median of 16 estimates in the informal poll, implying a gain of 6.3%.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.