BLOOMBERG

One of the pioneers of European Central Bank (ECB) monetary policy has a stark warning for officials about the threat of more inflation bearing down on the region’s economy.

Otmar Issing, the former Bundesbanker who became the first chief economist of the Frankfurt-based institution in 1998, reckons further consumer-price pressures may already be in the pipeline.

“I expect that we will see wage increases, which will create new inflation shocks,†the 86-year-old German economist said in an interview in his study in Würzburg, 120 kilometres away from the Frankfurt home of the ECB.

The remarks by a veteran policymaker synonymous with hawkishness are all the more poignant after a week when data showed underlying consumer-price growth in the euro zone at a new record high.

Worry about persisting pressures is prompting officials to vow further aggressive increases in borrowing costs even after 300 basis points in hikes since July.

In recent days, investor bets showed for the first time an expectation for the ECB’s deposit rate to reach 4%.

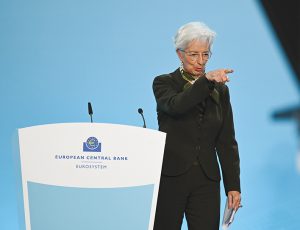

Surrounded by books including The Inflation of 1923 by Frank Stocker — a tome on the crippling hyperinflation of Germany’s Weimar Republic — Issing has harsh words for the failure of the ECB under President Christine Lagarde to have kept consumer prices in check.

“To act early is the best approach,†he said. “The ECB missed that by quite a lot.â€

Issing’s warning of renewed consumer-price surges reflects his analysis that there’s more to the current shock than simply an energy spike caused by the war in Ukraine — a view of the world that Frankfurt officials don’t tend to dwell on.

“Inflation was already under way before it was exacerbated by the war,†he said. “I never understood why the ECB for so long neglected that inflation was rising.â€

Issing’s legacy in developing the central bank’s founding two-pillar framework, featuring both economic and monetary analysis, remained largely intact until it was modified as part of a strategy review a couple of years ago.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.