BLOOMBERG

Local retail investments may help double the assets in India’s monthly stock plans in five years, and cushion the market from any selloffs by foreign investors, according to Edelweiss Asset Management Ltd.

Assets invested monthly in the so-called systematic investment plans — a vehicle widely used by retail investors — could grow to about $4 billion by 2028 as more individual investors turn to the stock market, said Radhika Gupta, who is the only female chief of a major asset manager in the country, and oversees about $12 billion in assets.

“The amount of money that global investors have taken away from India has been added back via its domestic savings,†she said.

The wave of retail investing in India during the pandemic has refused to abate as widening digitisation and greater awareness of equity markets in smaller cities cement the trend, even as foreign fund selling pushes the key benchmarks towards technical correction.

However, Gupta doesn’t expect growth in retail investing to be linear. There may be hiccups especially during tough market conditions, she said, with global equities this year facing “more recessionary conditions before the returns materialise.â€

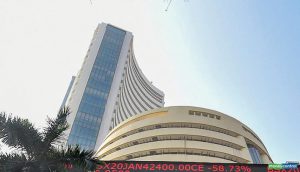

India’s Sensex and Nifty 50 indexes are down more than 6% each from all-time highs reached at the start of December. In that backdrop, Gupta has a preference for domestic demand-focused companies in the manufacturing and defense sectors.

Setting up the country’s first domestic hedge fund and exchange—traded corporate debt fund are among the feathers in the Mumbai-based executive’s cap, who faced a fair share of challenges in breaking through the ranks of male-dominated Dalal Street.

Edelweiss is among mutual fund houses that offer monthly investment plans to individual investors, country-wide contributions to which surged to about $1.7 billion by the end of January, from $1.4 billion a year ago.

“This is a story of financial inclusion. This is a story of the power of digitisation. This is the story of the power of India,†she said.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.