Abu Dhabi / WAM Emirates Foundation, an independent philanthropic organisation set up by the Abu Dhabi Government to facilitate public-private partnerships for empowering youth across the UAE, and Abu Dhabi Islamic Bank, ADIB, have partnered in support of financial literacy through Emirates Foundation’s programme, ‘Esref Sah’, which aims to educate youth on ways to manage their current and future financial …

Read More »TimeLine Layout

February, 2016

-

17 February

Mohamed visits martyr’s family

RAS AL KHAIMAH / WAM His Highness Sheikh Mohamed bin Zayed Al Nahyan, Crown Prince of Abu Dhabi and Deputy Supreme Commander of the UAE Armed Forces, offered his condolences to the family of the martyr Abdullah Juma Hassan Al Shamsi, who died in the line of duty while taking part in Arab coalition’s ‘Operation Restoring Hope’, to support the …

Read More » -

17 February

Crown Prince receives Qatari Foreign Minister

ABU DHABI / WAM His Highness Sheikh Mohamed bin Zayed Al Nahyan, Crown Prince of Abu Dhabi and Deputy Supreme Commander of the UAE Armed Forces, on Wednesday received visiting Sheikh Mohammed bin Abdulrahman Al-Thani, Qatari Minister of Foreign Affairs, at Al Shati Palace. Sheikh Mohamed welcomed Al-Thani and discussed with him ways to enhance fraternal relations between the two countries …

Read More » -

17 February

DEWA organises ‘Al Namoos’ workshop

Dubai / WAM In the presence of Saeed Mohammed Al Tayer, MD and CEO of Dubai Electricity and Water Authority, DEWA has organised a workshop on Wednesday at the Grand Hyatt Hotel in Dubai for over 250 consultants and contractors to update them about the Al Namoos service. DEWA’s recently-launched Al Namoos service is tailor-made to provide consultants and contractors …

Read More » -

17 February

JFSC Abu Dhabi Global Market sign agreement

ABU DHABI / WAM Memorandum of Understanding, (MoU) with the Financial Services Regulatory Authority (FSRA) of Abu Dhabi Global Market (ADGM) which puts in place a formal mechanism to enable the regulatory authorities to co-operate on supervisory matters and exchange of information to maintain the stability and well-being of the financial systems in each respective capital market. John Harris, Director-General …

Read More » -

17 February

UAE MoE hosts WTO Trade Policy Review delegation

ABU DHABI / WAM The UAE Ministry of Economy is currently holding a series of meetings with a visiting delegation from the World Trade Organisation’s Trade Policy Review Unit. The meetings form part of the preparatory process for WTO’s third review of the UAE’s trade policy that will take place at the Geneva headquarters from June 1 – 3, 2016. …

Read More » -

17 February

UAE’s Al Hilal Bank wins 2 awards

ABU DHABI / WAM Al Hilal Bank won the 10th Middle East Smart Government and City Customer Care Excellence Award, presented by the Middle East Excellence Awards Institute. The award was conferred to the organizations that displayed outstanding achievements in customer care, supporting the excellence-driven efforts and improving the smart government system. Mariam Ahli, Head of Corporate Communication at Al …

Read More » -

17 February

ADX introduces technical improvements on CBS

ABU DHABI / WAM In a drive to enhance its status on the local and regional level, the Abu Dhabi Securities Exchange (ADX) will introduce a developed version of the Circuit Breaker System (CBS) starting from Thursday. The improvements on the Circuit Breaker System based on the new method, offer many positive features such as the existence of two levels …

Read More » -

17 February

Dubai January inflation falls to 1.9 percent

DUBAI / WAM Dubai’s inflation rate fell 0.34 percent to 1.9 percent in January, compared to December last year, driven by a drop in transport costs, according to new figures released by the Dubai Statistics Centre. The January inflation rate of the Consumer Price Index (CPI) for the emirate showed that transport cost inflation fell 2.66 percent. Housing and utility …

Read More » -

17 February

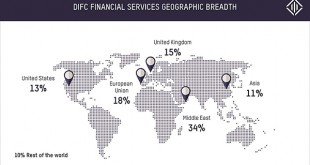

2015 an year of achievements, progress for DIFC

Dubai / EMIRATES BUSINESS Dubai International Financial Centre (DIFC), the global financial services hub connecting businesses and financial institutions with emerging markets across the Middle East, Africa & South Asia (MEASA), achieved another record year in 2015, was announced on Wednesday. The number of new company registrations at DIFC increased by more than a quarter (27%) compared with 2014, from 242 …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.