SHANGHAI / Reuters A controversial India-backed giant coal project near Australia’s Great Barrier Reef was on Sunday awarded mining leases, but developer Adani said it would not commit to a final investment decision until legal challenges against it were resolved. The Queensland state government said the Aus$21.7 billion (US$16.7 billion) project to build one of the world’s biggest mines was …

Read More »TimeLine Layout

April, 2016

-

3 April

China’s ZTE executives to step down amid US sanctions row

Bejing / AFP Chinese telecommunications giant ZTE will replace three top executives, the WSJ reported, in an apparent bid to see US restrictions on its business lifted after it was accused of violating sanctions against Iran. Washington slapped restrictions on ZTE and three linked companies last month for illicitly re-exporting controlled items from the United States to sanctioned countries, including …

Read More » -

3 April

Power outage grounds 78 flights in Manila

Manila / AFP A rare power outage plunged a major section of the Philippine capital’s main airport into darkness overnight, forcing flight cancellations that stranded thousands on Sunday. As many as 78 flights by the country’s largest carrier Cebu Pacific were cancelled, affecting nearly 14,000 passengers, the company said in a statement. Flag carrier Philippine Airlines also said some of …

Read More » -

3 April

Japan needs economic boost, says Komura

Tokyo / Bloomberg Japan will need economic measures in the second half of the current fiscal year after Prime Minister Shinzo Abe said the government will front-load budget spending, according to the vice president of the ruling Liberal Democratic Party of Japan. Implementing this year’s budget quickly will help address Japan’s weak consumer spending, said Masahiko Komura. “Then naturally there …

Read More » -

3 April

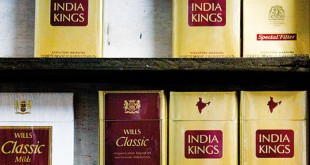

ITC halts cigarette production over health warning rules

New Delhi / Reuters Indian cigarette makers including ITC Ltd, part-owned by British American Tobacco, suspended production over what they said was ambiguity in the government’s new health warning rules for packs, a leading industry body said. Rules that mandated 85 percent of a cigarette pack’s surface to be covered in health warnings, up from 20 percent, kicked in from …

Read More » -

3 April

UK says govt contracts must consider local steel firms

London / Reuters Britain said on Sunday that UK steel producers must be considered for infrastructure and other government contracts involving steel supplies, as part of plans to find a long-term solution to a crisis in the industry. The government is looking for ways to support domestic steel producers after India’s Tata Steel put its loss-making British plant up for …

Read More » -

3 April

‘Brief nationalization’ of Tata UK biz, hints Javid

Bloomberg Business Secretary Sajid Javid declined to rule out a temporary nationalization of Tata Steel’s U.K. operations, while reiterating the government would prefer not to do so. “I don’t think nationalization is a solution for this,†Javid told BBC Television’s “Andrew Marr Show†on Sunday. “I also think it wouldn’t be prudent to rule anything out.†The British government is …

Read More » -

3 April

Port Talbot closure would tear hole in Brit manufacturing supply chain

Port Talbot, Wales / Reuters The closure of Tata Steel’s operations in Britain would leave a hole in manufacturers’ supply chains, dealing a blow to thousands of smaller firms across the country and creating a logistical headache for the car industry. India’s Tata Steel, Britain’s biggest producer, put all of its operations up for sale, including the country’s largest steelworks …

Read More » -

3 April

Romania’s biggest power producer to exit insolvency ‘latest by May’

Bucharest / Reuters Romanian state-owned power producer Hidroelectrica expects to finally exit its insolvency process by next month, and aims to sell a minority stake in an initial public offering by November, its manager told Reuters on Sunday. Romania’s largest and cheapest power producer has been run by a court-appointed manager after it became insolvent for the second time in …

Read More » -

3 April

Norway central bank chief Olsen will seek a 2nd term

Oslo / Reuters The governor of the Norwegian central bank will apply for a second, and final, six-year term, he told Reuters. “I am motivated to continue as governor, and can confirm that I will apply,†Olsen said. Oeystein Olsen Olsen, 64, has been governor of Norges Bank since January 2011. His six-year term can only be renewed once. By …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.