Washington /Â AFP The World Bank and the new China-backed Asian Infrastructure Investment Bank (AIIB), originally seen as possible rivals, joined hands with an agreement to co-finance projects. The two development banks signed off on a framework for working together on infrastructure programmes over the coming year which will give the World Bank some crucial oversight on how projects are …

Read More »TimeLine Layout

April, 2016

-

14 April

Lufthansa talks to SAS, Brussels Airlines to spread Eurowings

FRANKFURT / Reuters Lufthansa is in talks with the owners of Scandinavian carrier SAS and Brussels Airlines to expand the number of destinations it flies to and grow its low-cost Eurowings business, people close to the German airline said. Two sources said that Lufthansa had been in talks with the owners of SAS since the autumn, which could lead …

Read More » -

14 April

US retail sales fall in March as auto sales drag

Reuters US retail sales fell in March, dragged down by the auto sector, according to official data that suggested tepid consumer spending. The Commerce Department said retail and food services sales fell 0.3 percent in March and after sales in February were flat. The month-over-month decline was due to a 2.1 percent drop in motor vehicle sales. Stripping out …

Read More » -

14 April

Poundland sees return to sales growth this year

LONDON / Reuters British discount retailer Poundland expects to return to underlying sales growth this financial year after its last one was hit by disruption from the acquisition of a rival and the addition of more than 200 stores, it said on Thursday. The company, which sells everything from washing detergent to boxes of chocolates to packs of batteries …

Read More » -

14 April

Casino quarterly French sales up on growth at hypermarkets

Paris / Bloomberg Casino Guichard-Perrachon SA, the French grocery retailer targetted by short seller Carson Block, reported higher first-quarter sales in its home market, easing pressure on Chief Executive Officer Jean-Charles Naouri. Revenue in France rose 2.8 percent to 4.55 billion euros ($5.1 billion), Saint-Etienne, France-based Casino said on Thursday in a statement. Analysts predicted 4.52 billion euros. French …

Read More » -

14 April

McDonald’s targetting buyout firms as it seeks to sell North Asia stores

HONG KONG / Reuters In a bid to increase its retail footprint, McDonald’s Corp is targeting private equity firms, including Bain Capital, MBK Partners, TPG Capital Management and Chinese state-backed conglomerate China Resources (Holdings) for its planned sale of 2,800 restaurants in North Asia, people familiar with the matter told Reuters. The US fast food giant is adopting a …

Read More » -

14 April

Utility trumps luxury as China private jet buyers fly economy

SHANGHAI, SINGAPORE / Reuters Makers of private jets for China’s elite are shifting their focus from luxury to convenience, as a cooling economy and long-running crackdown on corruption prompt customers to demand smaller planes and even consider second-hand deals. Utility is the watchword, say industry insiders, as buyers who once enlisted Feng Shui masters to help them design cabin …

Read More » -

14 April

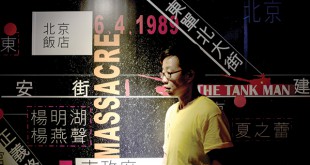

World’s first Tiananmen museum to close doors in Hong Kong

Hong Kong / AFP The world’s first museum dedicated to China’s Tiananmen Square crackdown is to close its doors in Hong Kong, with organisers saying they believe they are being targeted for political reasons. It comes at a time when concerns are growing in the semi-autonomous Chinese city that Beijing is tightening its grip. There has been keen interest in …

Read More » -

14 April

European inspiration with clear-cut interiors

Our Correspondent/ Emirates Business A casual yet refined dining concept serving French-European delicacies from 10 am until late evening, Classic Car Cafe boasts of a relaxing atmosphere and mouth-watering food served in the backdrop of classic cars. The perfect place to socialise — where business colleagues; families and groups of friends catch up over food. With the classic car …

Read More » -

14 April

Mindtripp: Doing the usual the unusual way

Our Correspondent / EMIRATES BUSINESS Mindtripp is an experiential events company with client relations spanning over a decade. Founded by Amrrita S Jhamm, a certified CSR practitioner, Mindtripp has been executing events on industry-level in sectors such as hospitality, tourism, education, finance and business. Jhamm, Chief Mindtripper, said, “At Mindtripp, we are all about creating experiential based events. That’s …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.