Paris / Bloomberg If the sudden disappearance of an EgyptAir flight turns out to be the work of terrorists, it will be the fourth such attack in the past year on air travelers in North African countries battling militant groups. Even as airports in Europe and North America have strengthened security, experts say that gaps in screening of employees …

Read More »TimeLine Layout

May, 2016

-

21 May

Lufthansa faces fresh ire over Germanwings crash

Berlin / AFP The head of Germany’s doctors’ association has lashed out at both Lufthansa and aviation regulators for failing to prevent last year’s Germanwings crash by allowing a pilot who suffered from severe depression to fly. Andreas Lubitz deliberately crashed flight A320 in the French Alps in March 2015, killing himself and the 149 others on board. Investigators subsequently …

Read More » -

21 May

France to test data sharing of air passengers

Paris / AFP France will test an EU-wide passenger data sharing system aimed at helping to detect extremists at two of its busiest airports later this month, a senior interior ministry official said on Saturday. The Passenger Name Record system, approved by the European Parliament in April, will be tested at Paris’s Charles de Gaulle airport and that of southeastern Nice …

Read More » -

21 May

Gap to shut 75 stores this year, 53 in Japan

New York /Â AFP Retail group Gap Inc. said it would shutter 75 stores this year amid sagging sales, including 53 of its kids-focused Old Navy brand outlets in Japan. Announcing a fall in first quarter earnings, the San Francisco-based retailer also warned that it might not achieve previous earnings forecasts for this year given the headwinds buffeting the apparel …

Read More » -

21 May

Solar Impulse plane leaves Oklahoma for Dayton

Washington /Â AFP An experimental, solar-powered aircraft took off from Tulsa in the midwestern US state of Oklahoma early on Saturday, kicking off the latest phase of its record-breaking quest to circle the globe without consuming a drop of fuel. Swiss businessman Andre Borschberg, who has teamed up with adventurer Bertrand Piccard for the Solar Impulse 2 project, piloted the …

Read More » -

21 May

China needs to up infra funding: Ex-PBOC adviser

Bloomberg Increasing infrastructure investment is the best way to boost economic growth in China and doing so doesn’t undermine efforts to overhaul the economy, according to former central bank adviser Yu Yongding. “If China does not increase infrastructure investment now, it may miss a historical opportunity,†Yu said on Saturday at an economics conference in Beijing. “In order to …

Read More » -

21 May

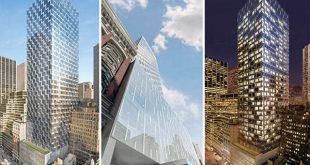

Condo-project financing taking longer than expected, says Extell

Bloomberg New York luxury-condo builder Extell Development Co. says it’s taking longer than expected to obtain construction financing for its One Manhattan Square project as lenders pull back from the market. Extell had anticipated getting a construction loan for the downtown project by the beginning of June, as a condition of closing a separate financing deal with RXR Realty …

Read More » -

21 May

A massive, newly renovated French Château could be yours for $11.4mn

Bloomberg When interior designer Timothy Corrigan bought Château du Grand-Lucé, an 18th century neoclassical mansion in France’s Loire Valley, for €2.2 million ($2.46 million) in 2005, “I figured I’d be there at least one weekend a month,†he said. “Last year, I was there a total of six days. This year, I haven’t been there once.†Now he’s putting …

Read More » -

21 May

Brazil stocks drop as homebuilders tumble

Bloomberg The Ibovespa extended a weekly drop as mining company Vale SA tumbled and real-estate companies slumped after a report that the government may cut the number of units to be built under its housing program. Vale was among the biggest contributors to the index’s slide on Friday amid lower metal prices. The BM&FBovespa Real Estate Index of 14 …

Read More » -

21 May

Vanishing Hong Kong housing packages strip bankers of peak views

Bloomberg Expat housing packages are so 2012. Long the golden privilege of the Hong Kong-based finance and banking crowd in Asia, the days of guaranteed housing allowances fat enough to rent a 4,000-square-foot harbor-view home on the Peak or a townhouse in exclusive Repulse Bay for HK$300,000 ($38,650) a month are gone. That perk is being slashed or eliminated, …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.