Hillsboro /Â AP A high-flying drone that will be used to test precision agriculture methods made its inaugural flight in North Dakota amid handshakes and smiles from aircraft operators and farm officials. The Israeli-manufactured Elbit Systems Hermes 450 aircraft took off from the Hillsboro airport to start a summer-long project that will take pictures of farmland in the fertile Red …

Read More »TimeLine Layout

May, 2016

-

22 May

Apple’s new retail statement

SAN FRANCISCO / AP Apple is getting ready to unveil a stylish new product that’s not for sale — a new look for its stores. The iPhone maker is overhauling its nearly 480 stores worldwide, starting with its new two-storey location in San Francisco. Apple provided a glimpse of its revised approach to retailing, the 15th anniversary of the …

Read More » -

22 May

Americans keeping rage in check

Los Angeles / AFP Bernard Minor spent 26 years behind bars for murdering a drug dealer who owed him US$400. Now, the ex-con spends his days teaching others to keep their rage in check, one of the swelling ranks of America’s anger therapists. “I was a very angry person,†the 58-year-old said. “I’d been living a violent life. Living …

Read More » -

22 May

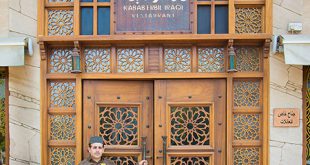

Dishing out delectable Iraqi cuisine

Our Correspondent/ Emirates Business Founded in 2003 by Azad Omar, Kabab Erbil Iraqi Restaurant is an Iraqi fine dining restaurant operating in the city of Dubai, UAE. Serving over 3,000 customers per week, the restaurant has become incredibly popular for its authentic Iraqi dishes and oriental setting in the restaurant, which leaves the customer with a unique experience. “In …

Read More » -

22 May

Setting new standards in professional nail lacquer

Our Correspondent / EMIRATES BUSINESS Sawaya International LLC is Morgan Taylor’s Middle East master exclusive distributor, specialised in professional beauty products covering salons and spas market. Brands selection based on quality of products, professionalism in distribution with 25 years’ experience and loyal clients network made Sawaya Int’l LLC successful in its business. With a leading market share in the …

Read More » -

21 May

Mohamed calls Sisi to condole crash victims

ABU DHABI / WAM His Highness Sheikh Mohamed bin Zayed Al Nahyan, Crown Prince of Abu Dhabi and Deputy Supreme Commander of the UAE Armed Forces, called the Egyptian President, Abdel Fattah El Sisi, to express his sincere condolences for the victims of the EgyptAir passenger plane crash in the Mediterranean on its flight from Paris to Cairo. HH …

Read More » -

21 May

Abu Dhabi, Finland and Azerbaijan discuss ties

ABU DHABI / WAM Helal Mohammed Al-Hameli, Deputy Director General of the Abu Dhabi Chamber of Commerce and Industry and Riitta Swan, Ambassador of Finland to the UAE discussed ways to enhance trade and investment co-operation between the Emirate of Abu Dhabi and Finland. During a meeting here in Abu Dhabi, Al-Hameli reviewed the services and facilitations provided by …

Read More » -

21 May

DEWA, TCS sign pact to boost Research and Development

DUBAI / WAM The Dubai Electricity and Water Authority (DEWA) signed a Memorandum of Understanding (MoU) with Tata Consultancy Services (TCS) to support DEWA’s strategy in Research and Development (R&D), sustainability, diversification of the energy mix, in an environment that nurtures innovation and creativity. The MoU was signed by Saeed Mohammed Al Tayer, MD and CEO of DEWA and …

Read More » -

21 May

UAE team showcases investment strengths

Abu Dhabi / WAM An official delegation from the UAE has successfully participated at the 8th Kazan International Economic Summit between the Russian Federation and member countries of the Organisation of Islamic Cooperation (OIC) from May 19-21, in Kazan, the capital of Russia’s Tatarstan Republic. The delegation was headed by Abdullah bin Ahmed Al Saleh, Under-Secretary of the Ministry of …

Read More » -

21 May

WAM takes part in FANA and Thomson Reuters workshop

London /Â WAM A joint workshop between the Federation of Arab News Agencies (FANA) and Thomson Reuters concluded in London on Friday night. The two-day workshop was attended by heads of the Arab news agencies and senior officials at Thomson Reuters. Topics discussed during the workshop included the future of news agencies in the digital age and means of cooperation …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.