Abu Dhabi /Â WAM Dr Amal Abdullah Al Qubaisi, Speaker of Federal National Council (FNC) sent a cable of greetings to HH Sheikha Fatima bint Mubarak, Chairwoman of the General Women’s Union, Supreme Chairwoman of the Family Development Foundation and President of the Supreme Council for Motherhood and Childhood, on the occasion of the Emirati Women’s Day. “The Emirati Women’s …

Read More »TimeLine Layout

August, 2016

-

25 August

ERC renovates Aden’s varsity housing complex

Aden / WAM The Emirates Red Crescent (ERC) on Thursday opened the university student housing complex in Madinat al-Shaab town, Aden governorate, after six months of restoration, maintenance, renovation and refurnishing. Consisting of five main buildings stretching over an area of around 59,500 square metres, the complex will accommodate 1500 students from across Yemen as well as Djibouti and Somalia. President …

Read More » -

25 August

UAE to treat 1,500 people injured in Yemeni war

Abu Dhabi /Â WAM Around 1,500 people who sustained injuries in the war in Yemen will receive medical care in hospitals in the UAE, Sudan and India, the Emirates Red Crescent (ERC) announced on Thursday. The ERC in a press statement said that the humanitarian medical gesture is in implementation of directives given by President His Highness Sheikh Khalifa bin …

Read More » -

25 August

AFG donates 20 boxes of aid material to ERC

Dubai /Â Emirates Business Al Fahim Group (AFG) has donated 20 boxes to the Emirates Red Crescent through the employee Box Appeal Campaign for the third consecutive year as part of its annual Ramadan CSR programme. Towards its participation, AFG employees donated various items such as clothes, blankets, tinned food, toys and toiletries, medicine, TV sets, printers and scanners, in …

Read More » -

25 August

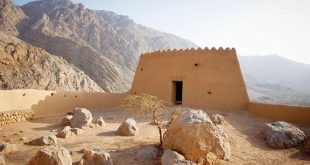

Hotel occupancy in Ras Al Khaimah rises 36.7% over July 2015

Ras Al Khaimah / Emirates Business Ras Al Khaimah Tourism Development Authority (TDA), which develops the emirate’s tourism infrastructure and oversees its domestic and overseas promotions, has revealed that total visitor arrivals between January and July increased by seven percent, compared to the same period in 2015, with further indicators foretelling another successful year for the region’s fastest growing …

Read More » -

25 August

Dubai Culture backs ‘green summer’ drive

Dubai / Emirates Business Dubai Culture & Arts Authority (Dubai Culture), the Emirate’s dedicated entity for heritage, arts and culture, has announced its support for the Dubai Electricity and Water Authority (DEWA) ‘Let’s Make this Summer Green’ environmental awareness campaign. The initiative, which will be implemented at the Dubai Public Library – Al Twar branch this month, will be …

Read More » -

25 August

MyUS.com launches Arabic version for GCC

Dubai / Emirates Business Catering to the Middle East’s growing demand for US goods, MyUS.com, America’s leading package forwarding and consolidation company, shipping more than 10,000 parcels daily around the world, has announced the expansion of its services in the GCC. As a result, customers residing in the GCC can now use MyUS.com in Arabic (MyUS.com/ar/) to sign-up for …

Read More » -

25 August

Sprint chooses datamena for data hub in UAE

Emirates Business datamena, the pioneering carrier neutral data centre and connectivity platform based in the UAE and servicing the Middle East and Africa (MEA) region, has announced the addition of Tier 1 Global Internet Service Provider (ISP), Sprint, to its list of partners. With ambitions to expand the reach of its network into the Middle East and Africa, Sprint …

Read More » -

25 August

‘1001Titles’ gets a boost

Emirates Business ‘1001Titles,’ an initiative from Sharjah-based cultural organisation Knowledge without Borders (KwB), has received a major boost following its manager’s completion of a leading publishing course at Yale University, USA. Majd Al Shehhi’s attendance at the prestigious Ivy League institution’s ‘Leadership Strategies in Book Publishing’ programme was aimed at enhancing the attributes of the initiative, which plans to …

Read More » -

25 August

Curtains fall on du summer training programme

DUBAI / Emirates Business du, the UAE-based telecommunications company with a focus on supporting and educating youth in the UAE, congratulated 15 dedicated Emirati students on the completion of its Summer Training Programme. To conclude their participation in the programme, the students were awarded ‘Work Experience Appreciation’ certificates during the graduation ceremony that was held at the du headquarters …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.