Bloomberg Preoccupied by ultra-low interest rates in much of the industrialized world, the financial industry risks being blindsided by an even bigger challenge, according to Russian central bank Governor Elvira Nabiullina. “Banks could fall into a trap,†Nabiullina said at a conference in Kazan, capital of Russia’s republic of Tatarstan. “What do they mostly complain about now? Low interest …

Read More »TimeLine Layout

October, 2016

-

13 October

‘Brexit doom misplaced as opportunities knock’

Bloomberg Foreign Secretary Boris Johnson has said predictions of “doom†for the British economy following the decision to leave the European Union are misplaced and “will continue to be proved wrong†as the U.K. negotiates its departure from the bloc. Britain will get a good deal from the remaining member states because it is in the interests of those …

Read More » -

13 October

Marmite taken off UK shelves as Brexit bites

London / AFP British staple Marmite was taken off the virtual shelves at supermarket Tesco on Thursday, following a reported row with supplier Unilever over pricing after the pound plummeted on fears over the UK’s Brexit plans. Jars of Marmite were “currently not available” in the online store of Tesco — the world’s third biggest supermarket chain — after …

Read More » -

13 October

Maduro bypasses Venezuelan legislature on country’s budget

Caracas / AFP Venezuelan President Nicolas Maduro can pass his 2017 budget without the approval of the opposition-majority legislature, the Supreme Court ruled, triggering an outcry from the leftist leader’s opponents. Maduro and the National Assembly have been at each other’s throats since the center-right opposition took control of the legislature in January, ending the left’s 17-year monopoly on …

Read More » -

13 October

German court gives govt green light for Canada-EU trade deal

Berlin / AFP Germany’s top court on Thursday gave the government the go-ahead to approve a planned EU-Canada free trade deal, in a setback for activists who had sought to block the agreement. The Constitutional Court did set certain conditions however, stipulating that Germany may only commit to the so-called CETA deal if it wins assurances that it can …

Read More » -

13 October

EU misspent €5.5bn, needs to regain trust, warns watchdog

Brussels / AFP The EU misspent 5.5 billion euros ($6 billion) in 2015, the bloc’s financial watchdog said Thursday, warning that Brussels needed to regain the trust of European citizens shaken by Brexit and other crises. Badly spent funds went on paying overcharged personnel costs for developing cloud computing services, it said. Another example included aid earmarked for small- …

Read More » -

13 October

Coke, Pepsi fund health groups… but fight them too

New York / AFP Coca-Cola and Pepsi, the two major US soda giants, have given millions of dollars to health organizations while quietly fighting anti-obesity measures such as taxes on soft drinks, a new study shows. The Coca-Cola Co and PepsiCo, from 2011 to 2015, sponsored 96 national health organizations battling public health problems such as obesity, diabetes and …

Read More » -

13 October

Trump disaster lets GOP slide on tax policy

In a kinder, gentler, alternate universe, Ohio Governor John Kasich is the Republican nominee for president. Former Florida Governor Jeb Bush is out stumping for Kasich and plotting the education and immigration policies that he’ll pursue in the vice president’s office. (Substitute Senator Marco Rubio in the veep slot if you prefer; I went with the Floridian who demonstrated …

Read More » -

13 October

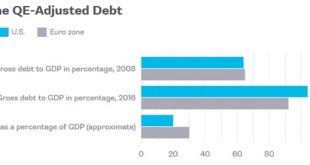

Delivering growth in the coming post-QE world

Over the past eight years, the major central banks have increased their balance sheets to $18 trillion from $6 trillion, predominantly through the purchase of their own government’s bonds. While the Fed has ended its QE program, the European Central Bank and Bank of Japan continue theirs. But those too will eventually come to an end. What happens next …

Read More » -

13 October

The trouble with referendums isn’t stupid voters

Events have lately been mounting an impressive case against referendums. Britain voted to leave the European Union. Colombia rejected a deal to end its decades-long conflict with FARC revolutionaries. Hungary just said no to (modest) European Union quotas for the resettlement of refugees. Poor choices all. These recent cases aren’t anomalies. They’re consistent with a history of bungled decisions …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.