Abu Dhabi / Emirates Business Abu Dhabi Tourism & Culture Authority (TCA Abu Dhabi) is spearheading a delegation to World Travel Market (WTM) in London, UK from November 7-9 to promote the emirate as a destination of distinction in conjunction with a new global destination campaign which was launched last week. Joining the Authority at the leading global event …

Read More »TimeLine Layout

November, 2016

-

5 November

MBRSC showcases UAE space programme at forum

Dubai / Emirates Business The Mohammed bin Rashid Space Centre (MBRSC) has participated in the World Space Risk Forum (WSRF) 2016, the global event that brings together a large number of international experts and specialists in the field of space industry from around the world. During the opening session, the forum rewarded MBRSC with the Inspiration Award, as Salem …

Read More » -

5 November

UAE outperforms peers in health and wellbeing

Dubai /Â WAM The United Arab Emirates has made a noticeable surge in the Legatum Prosperity Index, thanks to its impressive performance in many areas, including health and wellbeing. “True prosperity is as much about wellbeing as wealth and the UAE is the best in the region at delivering it,” said a report published recently by Legatum Institute, an international …

Read More » -

5 November

DSOA, UD hold seminar to boost creativity, innovation in youth

Dubai / Emirates Business Dubai Silicon Oasis Authority (DSOA), the regulatory body for Dubai Silicon Oasis (DSO), the integrated free zone technology park, in collaboration with the University of Dubai (UD), organised a Happiness Lab workshop entitled ‘Future of the Work Environment for the Youth’. The workshop that was hosted at the university premises and visited by Dr Mohammed …

Read More » -

5 November

Dubai summit to focus on evolution of clean mobility

Dubai / Emirates Business The development of electric, autonomous, and connected vehicles in the Gulf Cooperation Council (GCC) will be in sharp focus at a conference and exhibition in Dubai this month, as the Emirate’s government takes a lead role in the future of regional mobility. The 2nd International Conference on Future Mobility, to be held from November 14-15 …

Read More » -

5 November

Govt starts final evaluation of innovative ideas for Afkari

Dubai /Â WAM The UAE federal government has launched the final phase of evaluating innovative ideas submitted by federal government employees for Afkari, a government initiative launched last year to support innovation in the sector, the Mohammed bin Rashid Centre for Government Innovation said on Saturday. Some 750 innovative ideas were submitted and the huge number required a higher evaluation …

Read More » -

5 November

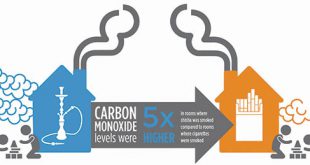

‘Secondhand shisha smoke worse than that of cigarettes’

Abu Dhabi / Emirates Business A new study by the NYU Abu Dhabi Public Health Research Center revealed that smoking shisha at home exposes children and non-smokers in the home to even more harmful pollutants than secondhand smoke from cigarettes. Air pollution was studied in 33 homes in the United Arab Emirates: 11 where only shisha was smoked, 12 …

Read More » -

5 November

GMIS to put manufacturing at heart of future coop with Poland

Dubai / Emirates Business The Global Manufacturing and Industrialisation Summit (GMIS) has underscored its role as a facilitator and global promoter of manufacturing activities by signing a pact with the Polish Chamber of Commerce to strengthen manufacturing links between Poland and the global community. GMIS, which will be held in the UAE’s capital, Abu Dhabi, in March 2017, is …

Read More » -

5 November

GAIAE inaugurates eco-friendly mosque

Dubai / Emirates Business Diamond Developers, the real estate company behind The Sustainable City — the region’s first fully operational and integrated sustainable community in Dubai — announced the official opening of its eco-friendly Mosque, which was inaugurated by a delegation from the General Authority of Islamic Affairs & Endowments (GAIAE). The green Mosque has a total floor area …

Read More » -

5 November

YZER Property offers free listing for realty brokers

Dubai / Emirates Business There are over 6,000 registered realty brokers in Dubai as per the latest statistics by the Real Estate Regulatory Authority, the Dubai Government entity regulating real estate organizations and agents in the emirate. In a lead up to EXPO 2020, the local property sector is expected to witness rapid growth with robust construction and transactions. …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.