ISTANBUL / AP Turkey’s prime minister says an agreement between Russia, Turkey and Iran on how to monitor a cease-fire between warring parties in Syria marks a “serious diplomatic success.†Binali Yildirim said on Wednesday that the agreement could pave the way for a political solution in the war-torn nation. The deal was announced by the three countries the previous …

Read More »TimeLine Layout

January, 2017

-

25 January

EU leaders urged to back migrant measures for Libya

BRUSSELS / AP The European Commission is urging European leaders to endorse sweeping measures to help stop tens of thousands of desperate people from leaving Libya in search of better lives in Europe. The commission said in documents published on Tuesday that the leaders should “deploy the full range of EU missions and projects†to help Libyans manage their borders …

Read More » -

25 January

May gives in to demands to publish Brexit plan

Bloomberg UK Prime Minister Theresa May said she will publish her plan for negotiations to leave the European Union after lawmakers demanded greater scrutiny in Parliament. May said a so-called white paper will be published to allow proper debate of the strategy she outlined in a speech last week. “I have been clear, as have senior ministers, that we’ll …

Read More » -

25 January

Hong Kong denies Beijing role in Singapore shipment probe

HONG KONG / AP Hong Kong’s customs chief on Wednesday denied suggestions that Beijing was involved in the investigation into nine armored personnel carriers belonging to Singapore that were seized in the Chinese-controlled territory. Commissioner Roy Tang said his department was acting only under Hong Kong law when it impounded the nine SAF Terrex infantry carriers and other equipment. He …

Read More » -

25 January

France presidential hopeful Macron gains support

PARIS / AP The real winner of France’s left-wing presidential primary may be a man who demonstrably shunned it: Emmanuel Macron. The 39-year-old former investment banker and ex-economy minister with pro-free market, pro-European views has chosen not to take part in the Socialist primary. Instead, in recent days he has been drawing attention away from the campaign by traveling to …

Read More » -

25 January

4 killed in trio of suicide attacks in Nigeria

MAIDUGURI / AP At least four people were killed in three attacks by suicide bombers in Nigeria’s northeastern city of Maiduguri, police and witnesses said on Wednesday. The first attack late Tuesday involved a male bomber who was shot dead by a military sniper after he was seen moving towards a security checkpoint, said Damian Chukwu, police commissioner of Borno …

Read More » -

25 January

Alibaba adds $7.5bn in market value after raising forecast

Bloomberg Alibaba Group Holding Ltd. added $7.5 billion to its market value after reporting quarterly results that beat estimates and raising its full-year sales forecast. China’s biggest e-commerce company increased its projection for fiscal 2017 revenue growth to 53 percent, from 48 percent previously, as Chinese spending stays strong and the company wrings revenue from fledgling areas such as …

Read More » -

25 January

Boeing profit gets boost as 787 turns from drag to rainmaker

Bloomberg Boeing Co. profit rose as the 787 Dreamliner emerged from a decade of losses and helped the planemaker weather a turbulent market for wide-body jetliners. Adjusted earnings were $2.47 a share, despite an accounting loss for an aerial tanker program, the company said on Wednesday in a statement. That exceeded the $2.32 average of analyst estimates compiled by …

Read More » -

25 January

S&P downgrades Rolls-Royce rating

Bloomberg Standard & Poor’s (S&P) downgraded Rolls-Royce Holdings Plc’s credit rating to three levels above junk after factoring in 670 million pounds ($836 million) in fines for bribery and corruption charges. The aircraft engine-maker’s long-term investment rating has been downgraded to BBB+ from A-, S&P said in a statement, cautioning that a new mandatory accounting system could weigh on …

Read More » -

25 January

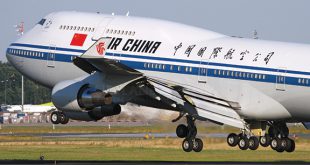

EU spares foreign flights from carbon curbs through 2020

Bloomberg The European Union will propose extending an exemption on foreign flights from its carbon market until 2020 after nations worldwide reached a historic deal last year to introduce a global system to curb the growth of emissions from airlines. The European Commission, the EU’s regulatory arm, will probably present a draft law on Feb. 3 sparing carriers, ranging …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.