Bloomberg Rising trade tensions are pushing Chinese car-wheel maker Wanfeng Auto Holding Group to seek further acquisitions in the US to help localize more production and cut its reliance on imports. The Xinchang-based auto parts supplier is in talks to buy a machinery company in the US, and is open to purchasing a business in the financial industry, Wanfeng …

Read More »TimeLine Layout

March, 2017

-

12 March

Beijing tries to reassure foreign companies over industry plan

BEIJING/ AP China’s industry minister defended a manufacturing development plan and rejected complaints foreign makers of electric cars and other goods might be pressured to hand over technology or forced out of promising markets. Miao Wei, minister of industry and information technology, tried to reassure foreign companies that the “Made in China 2025†industry plan treats all companies equally. …

Read More » -

12 March

‘India companies won’t invest anytime soon’

Bloomberg Indian companies probably won’t invest in additional capacity for at least another year as the private sector struggles with sluggish domestic demand and growing protectionism overseas, according to the nation’s largest engineering firm. “The private sector has excess capacity and markets have shrunk as compared to their plan when these capacities were put up,†said R. Shankar Raman, …

Read More » -

12 March

Republicans still battle each other even after gaining power

WASHINGTON / AP Less than twenty-four hours after Donald Trump had won the White House, House Speaker Paul Ryan triumphantly proclaimed the start of a new era of Republican leadership that would “hit the ground running.†Six weeks into Trump’s administration, Republicans are running — just in different directions. As congressional leaders move forward with efforts to undo former …

Read More » -

12 March

Jordan releases soldier ‘who killed 7 Israeli girls in 1997’

AMMAN / AP A Jordanian soldier who killed seven Israeli schoolgirls in a 1997 shooting rampage was released on Sunday, after serving 20 years in prison. Ahmed Daqamseh opened fire on the eighth graders while they were on a class trip to the scenic “Island of Peace†border post, killing seven girls and wounding seven others. A Jordanian court …

Read More » -

12 March

Madagascar cyclone death toll reaches 50, authorities say

JOHANNESBURG / AP Madagascar’s government says the death toll from Cyclone Enawo has risen to at least 50, with 20 people missing. The island nation’s disaster management agency on Sunday said the cyclone that made landfall in the northeast on Tuesday also has driven 110,000 people from their homes. At least 183 people were injured. Enawo brought heavy rains …

Read More » -

12 March

15 killed, dozens missing in Ethiopia garbage dump landslide

ADDIS ABABA / AP A landslide swept through a massive garbage dump on the outskirts of Ethiopia’s capital, killing at least 15 people and leaving several dozen missing, residents said, as officials vowed to relocate those who called the landfill home. Addis Ababa Mayor Diriba Kuma said 15 bodies had been recovered since the landslide Saturday night at the …

Read More » -

12 March

S Korea’s Park quits Blue House, expresses defiance

SEOUL / AP Ousted South Korean President Park Geun-hye expressed defiance towards the corruption allegations against her as she vacated the presidential palace and returned to her home on Sunday, two days after the Constitutional Court removed her from office. In her first public comments since the court’s ruling, Park said in statement, “Although it will take time, I …

Read More » -

12 March

Dutch PM seeks to defuse tensions with Turkey

ROTTERDAM / AP After an unprecedented diplomatic fight between the Netherlands and Turkey, Dutch Prime Minister Mark Rutte said on Sunday he would seek to control the damage caused by the weekend incidents when he prevented two Turkish ministers from campaigning in the Netherlands. Rutte’s actions, which came two days after several German municipalities canceled rallies that Turkish Cabinet …

Read More » -

12 March

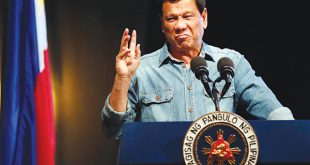

Philippines, communist rebels agree to resume talks, truce

MANILA / AP The Philippine government and communist rebels have agreed to resume peace talks and restore separate cease-fires after an escalation of deadly clashes, officials said on Sunday. Government and rebel negotiators will resume talks early next month and discuss the terms of a broader cease-fire, presidential adviser Jesus Dureza said. Norway, which has been brokering the negotiations, …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.