Dubai / WAM His Highness Sheikh Mansour bin Mohammed bin Rashid Al Maktoum, on Thursday officially opened the world’s largest Lamborghini showroom in Dubai to accommodate its expanding fleet of extravagant high-performance cars. Located on Sheikh Zayed Road, the 1800 square metres dealership is the largest Lamborghini showroom and service centre in the entire world and spans across three …

Read More »TimeLine Layout

April, 2017

-

27 April

EAG, ERC to facilitate Umrah for 15 people

Abu Dhabi / WAM Etihad Aviation Group (EAG) has taken part in a philanthropic collaboration with Emirates Red Crescent (ERC) to support a group of 15 travellers in experiencing the holy pilgrimage of Umrah. Last week, nationals from Sudan, Yemen, Morocco, Bangladesh, Palestine, India and Pakistan were provided with flights and accommodation for the four-day trip to Saudi Arabia …

Read More » -

27 April

Black Box Cinema highlights regional talent at ADIBF

Abu Dhabi /Â WAM A refreshed Black Box Cinema project by the celebrated Emirati filmmaker Nawaf Al Janahi, is currently being featured at the 27th edition of the Abu Dhabi International Book Fair (ADIBF), at the Abu Dhabi National Exhibitions Centre, (ADNEC), which opened on Wednesday and runs until May 2. ADIBF is held under the patronage of His Highness …

Read More » -

27 April

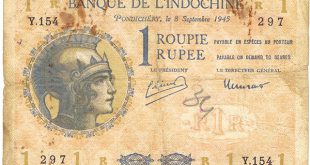

Dubai exhibition marks 100th anniv of Indian 1-Rupee note

Dubai / Emirates Business As the Indian one-rupee note completes its century, the people in UAE will be treated to an exclusive display of 100 different Indian one-rupee notes, issued from 1917 to 2016. To commemorate the occasion, Dubai-based numismatics company, Numisbing and International Bank Note Society, Dubai Chapter (IBNS Dubai) are jointly holding an exhibition to take visitors …

Read More » -

27 April

Merkel warns of UK ‘illusions’ in hard-line Brexit speech

Bloomberg German Chancellor Angela Merkel laid down a tough line for Brexit talks with the UK, reminding Britain it can’t expect preferential treatment as she warned that some officials in London were harboring “illusions.†Addressing the German parliament before the remaining 27 European Union leaders meet on Saturday to discuss Britain’s exit, Merkel said the bloc will put its …

Read More » -

27 April

Erdogan’s guards among 9,000 suspended officers

Bloomberg Turkey suspended 9,000 police officers, including more than a dozen tasked with protecting President Recep Tayyip Erdogan and his family, extending a crackdown on suspected followers of a U.S.-based cleric who the government blames for orchestrating last year’s attempted coup. The officers were suspended for ties to the “terrorist network of Fethullah Gulen and for posing a threat …

Read More » -

27 April

Putin, Trump may meet before July G-20 summit, Russia says

Bloomberg Russia and the U.S. are preparing for a possible first meeting between Vladimir Putin and Donald Trump before the two presidents attend July’s Group of 20 summit in Germany, according to Russian Deputy Foreign Minister Sergei Ryabkov. “There are preparations,†Ryabkov said on Thursday in a text message. “The issue of whether the schedules of both leaders can …

Read More » -

27 April

Pentagon’s watchdog probes Flynn speech payments

Bloomberg The Defense Department’s inspector general is investigating whether former National Security Adviser Michael Flynn “failed to obtain required approval†for a speech to a Russia-backed media network, according to an April 11 letter released on Thursday by the top Democrat on the House Oversight Committee. The Democrat, Elijah Cummings of Maryland, also released an October 2014 letter from …

Read More » -

27 April

Saudi banks strong in light of brewing changes in industry

DUBAI / Reuters Shares in two Saudi banks that are in early merger talks moved in opposite directions on Thursday while other regional markets ended the week down as investors had little fresh company earnings and news to reallocate their funds or build positions. Alawwal Bank extended the previous session’s 8.6 percent gains, adding 2.2 percent. Shares in Saudi …

Read More » -

27 April

US stocks mixed, euro falls on ECB

Bloomberg US stocks fluctuated with the dollar as the Trump administration signaled its commitment to Nafta, while the euro edged lower after the European Central Bank boosted its assessment of the region’s economy without discussing tapering asset purchases. Crude sank below $49 a barrel. The S&P 500 Index’s move toward an all-time high faltered anew and Treasuries slipped after …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.